Today we are going to introduce you to a brief overview of Forward Contracts and why they can be beneficial. In under 5 minutes you will have a better idea of how to maximise the value of your money when buying an overseas property.

Hey everyone and welcome to another edition of MyCurrencyTransfer TV. In today’s episode, we’re going to discuss: what is a forward contract when making a money transfer? Many private clients who use our money transfer comparison tool are emigrating and buying property abroad, of which, many of whom are booking in forward contracts as a way to manage currency risk when making international payments.

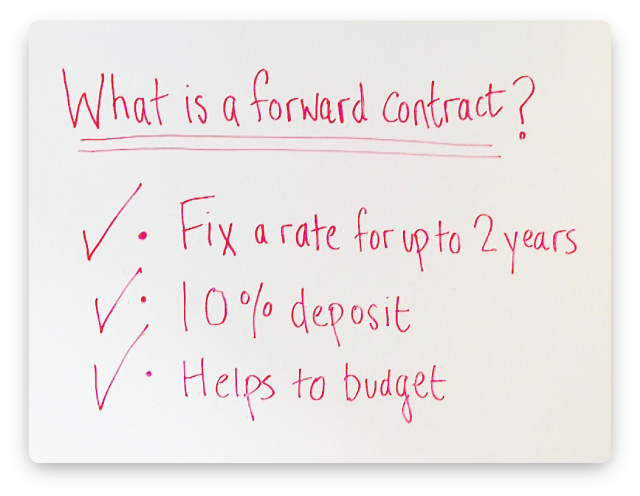

So, what is a forward contract?

Let’s start with an example of the real impact on adverse currency fluctuations. £300,000 at the start of the year could have bought you 370,000 EUROS. If we fast forward just a few months, the same £300,000 could only be exchanged for 340,000 EURO, purely because of exchange rate swings between GBP and EUR. That’s a real money loss of 30,000 EUROS. Ouch! Thankfully, there is a way to manage this foreign exchange risk.

Fix a rate for up to a year in advance

Forward contract lets you lock in today’s exchange rate – for delivery in up to two years in advance. Research from MyCurrencyTransfer panel of broker partners shows around 8% of all currency transfers introduced are forward contracts. Typically, they are appropriate for much larger money transfers.

10% Deposit

A deposit of around 10% is required by money transfer companies up front, with the balance settled when the currency contract matures.

Mitigate against risk of adverse currency fluctuations

A forward contract helps mitigate against the risk of exchange rate fluctuations & the rate moving against you. Adverse currency fluctuations can be a disaster when buying an overseas property & can sometimes put your dream second home abroad suddenly out of budget. You don’t want this to happen & taking the earlier example, you don’t want your property to cost over £20,000 more.

Keep your property within budget

The main benefit of a forward contract is peace of mind. The ‘buy now, pay later approach’ removes any element of risk of adverse currency fluctuations. When buying overseas property, you simply cannot take the risk of varying property prices in between agreeing to buy a property and completing

Helps you stick to a budget

Thankfully, by using a forward contract with a foreign exchange specialist, you can ensure your property, emigration or large money transfer stays within budget, even if the exchange rate moves against you.

Good luck! If you have any questions, don’t hesitate to reach out to us on twitter with the @currencytransfr handle!