Dubai Property for UK Buyers

0% tax. 7-hour flight. Only 3-4 hours ahead. Here's why 14,000 UK residents search "buy property Dubai" every month.

Why UK Buyers Choose Dubai

Tax-free gains. High yields. A property market that doesn't punish landlords. Dubai offers UK buyers what the UK no longer does.

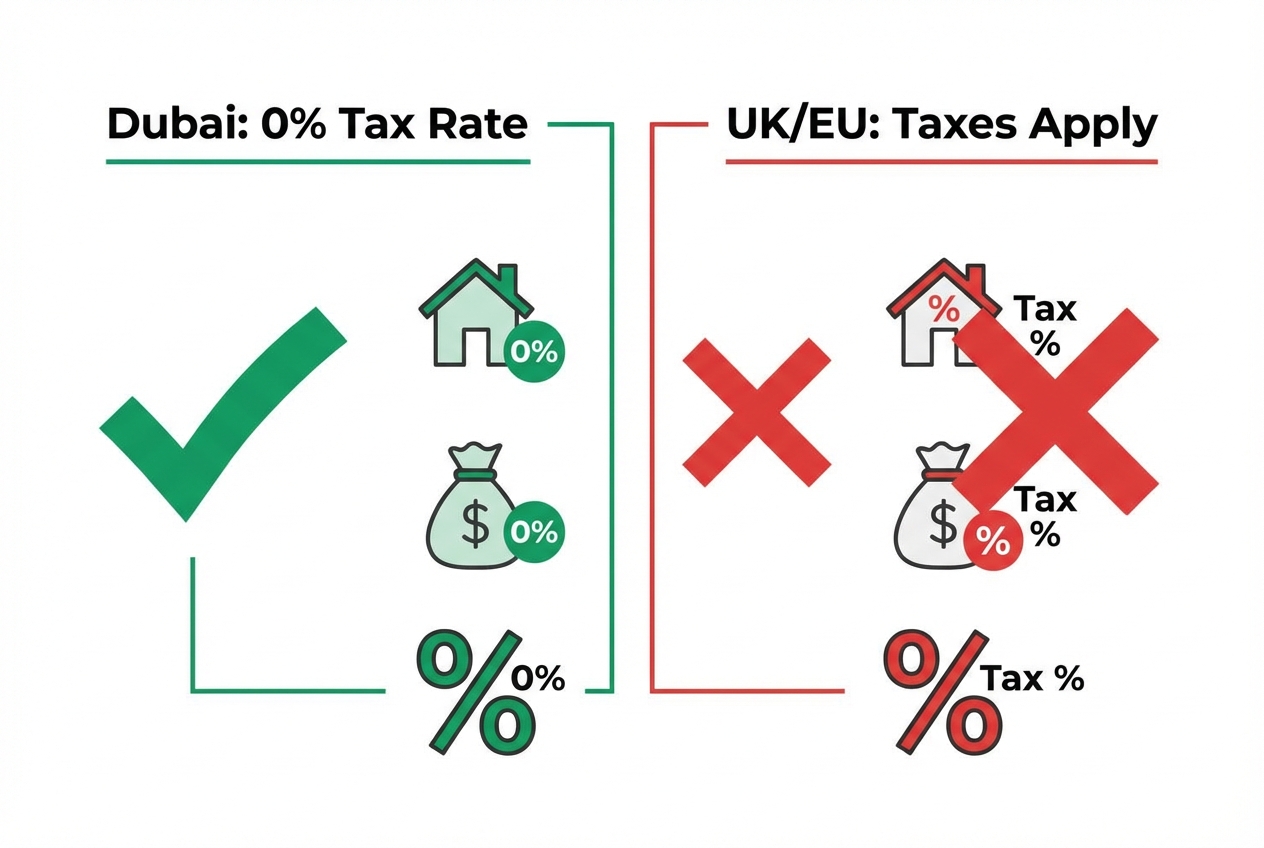

UK vs Dubai: Tax Comparison

The numbers that make UK landlords weep.

| Tax Type | UK | Dubai |

|---|---|---|

| Capital Gains Tax | 18-28% | 0% |

| Rental Income Tax | 20-45% | 0% |

| Stamp Duty (on purchase) | 3-15% | 4% |

| Annual Property Tax | Council Tax | None |

| Inheritance Tax (UAE) | 40% | 0%* |

UK vs Dubai Tax Comparison

See why UK landlords are looking East for better returns

UK Tax Obligations

UK tax residents remain liable for worldwide income and gains. *UK inheritance tax (40%) may still apply to Dubai property for UK-domiciled individuals. Consult a cross-border tax specialist. This is not tax advice.

5-Step Buying Process

From London sofa to Dubai title deed. Here's how it works.

Research and Budget

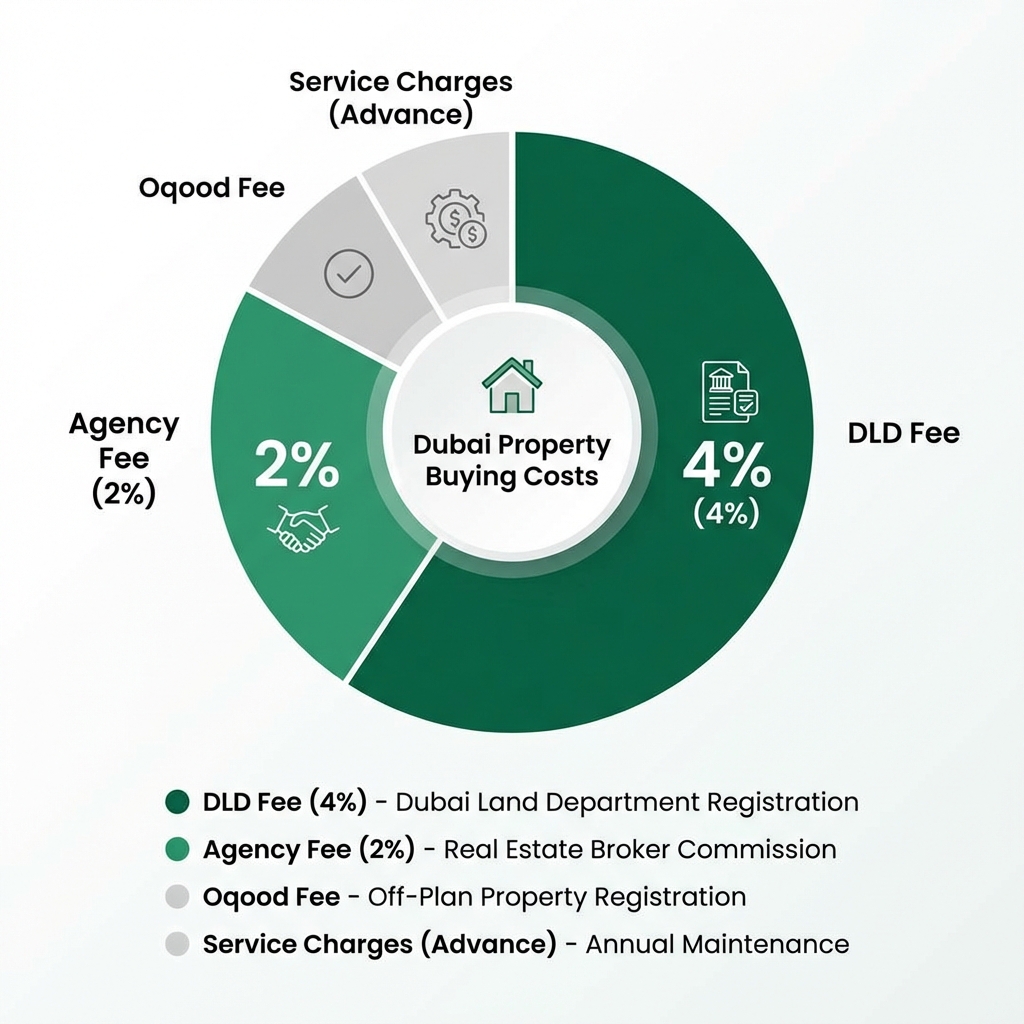

Define your budget in GBP. Research areas (Marina, Downtown, JVC). Factor in total costs: property price + 7-8% in fees (4% DLD, 2% agency, 1-2% other).

Lock in Your Exchange Rate

GBP/AED volatility can cost you thousands. Lock a rate with a specialist broker before you commit. Potential savings vs banks: 2-4%.

Reserve the Property

Pay 10% booking deposit to secure. Sign Sales Purchase Agreement (SPA). For off-plan: Oqood registration with DLD.

Complete Payment

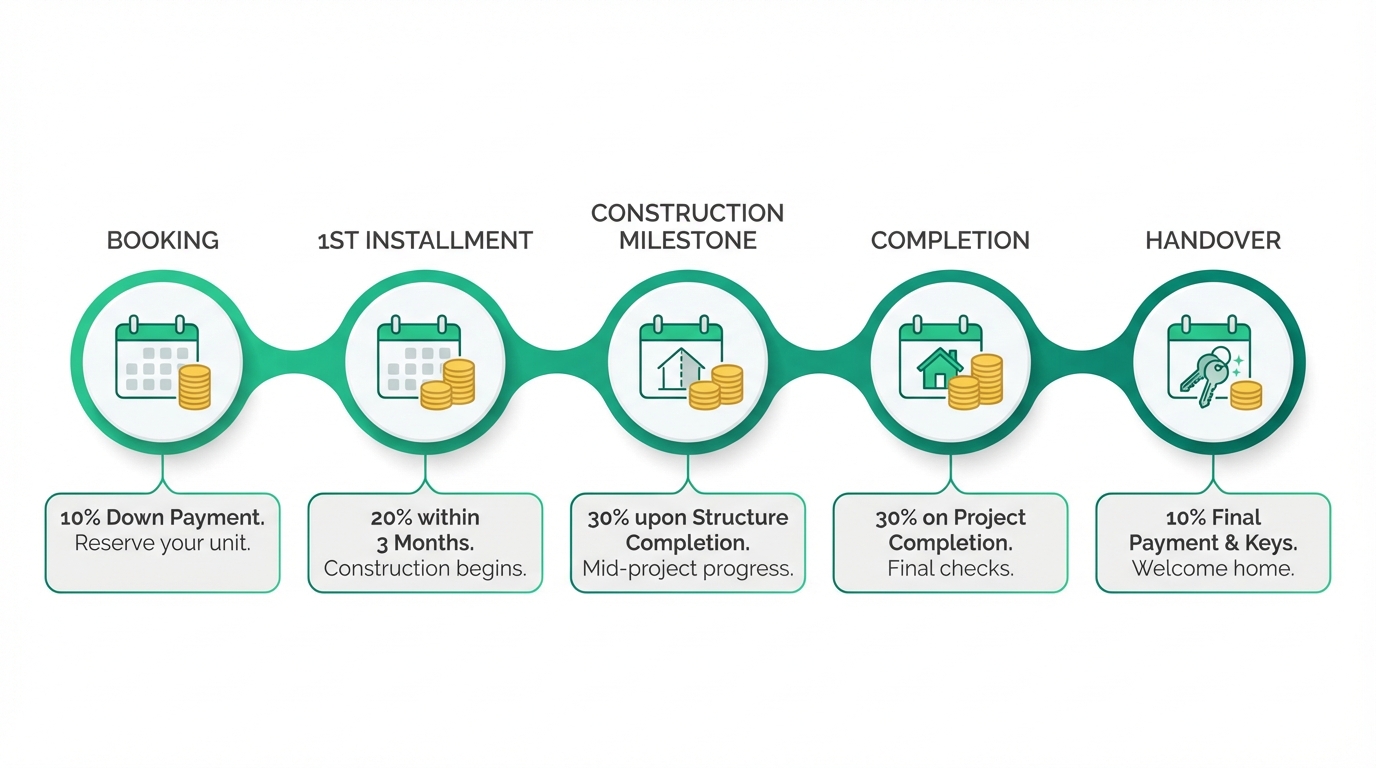

Transfer remaining funds per schedule. Ready property: balance on transfer. Off-plan: staged payments over 2-3 years (30/70, 50/50 plans).

Register and Collect Title

Final transfer at Dubai Land Department. Pay 4% DLD fee. Receive title deed. You now own freehold property in Dubai.

Off-Plan Payment Schedule

How staged payments work over your construction period

Golden Visa for UK Buyers

Buy AED 2M+ property, get 10-year UAE residency. No employer needed. Sponsor your family. No strict minimum stay requirement.

Frequently Asked Questions

Can UK citizens buy property in Dubai?

Yes. UK citizens can buy freehold property in designated areas with no restrictions. No visa required to own, though Golden Visa available through investment.

How much tax do I pay on Dubai property?

Zero in Dubai. No CGT, no rental income tax, no inheritance tax. UK tax residents may still have UK obligations on worldwide income.

What exchange rate will I get for GBP to AED?

Banks charge 3-5% margin. Specialist brokers offer 2-4% better rates. On a AED 2M purchase, that's potentially GBP 15,000+ saved.

Do I need to visit Dubai to buy?

No. Power of Attorney enables remote purchase. But visiting to view properties is recommended for first-time buyers.

Can I get a mortgage as a UK resident?

Yes. UAE banks lend to non-residents: 50-60% LTV, 25-year terms, ~4-5% rates. Need UK bank statements and proof of income.

Legal Disclaimer

This guide is for informational purposes only and does not constitute financial, tax, or legal advice. Property investment carries risks including loss of capital. Exchange rates fluctuate and past performance is not indicative of future results. UK tax residents should consult a qualified cross-border tax advisor regarding their obligations. MyCurrencyTransfer is a comparison service and does not provide property purchasing services.