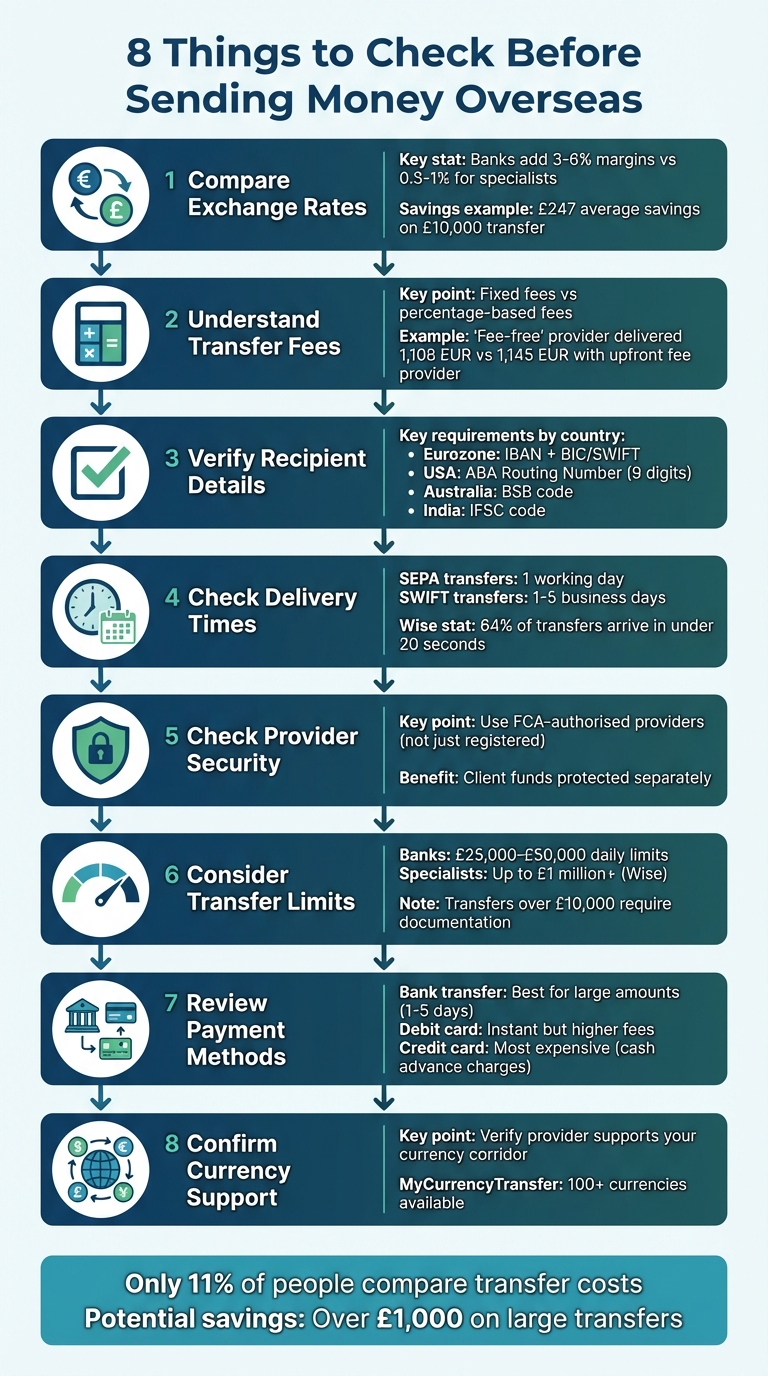

Sending money abroad can be tricky, with hidden fees, fluctuating exchange rates, and potential mistakes. To avoid costly errors, follow these 8 steps:

- Compare Exchange Rates: Check live rates across providers. Even small differences can save you hundreds, especially on large transfers.

- Understand Fees: Look beyond "fee-free" claims. Hidden exchange rate margins can cost more than upfront fees.

- Verify Recipient Details: Double-check account numbers, names, and country-specific codes (e.g., IBAN, BSB) to avoid delays or misdirected funds.

- Check Delivery Times: Transfer speeds vary by provider, currency, and destination. Some transfers take minutes, others days.

- Ensure Provider Security: Use FCA-authorised providers to protect your money and access dispute resolution if needed.

- Know Transfer Limits: Providers may cap daily or per-transaction amounts. Be prepared with documents for large transfers.

- Choose Payment Methods Wisely: Bank transfers are often cheaper for large sums, while debit cards or wallets are faster but may cost more.

- Confirm Currency Support: Ensure the provider handles your desired currency to avoid conversion issues or failed transfers.

Key takeaway: Comparing providers like MyCurrencyTransfer can save you money by showing real-time rates and fees from FCA-regulated services. Always verify the details to ensure your transfer is smooth, secure, and cost-effective.

8-Step Checklist for Sending Money Overseas Safely and Cost-Effectively

1. Compare Exchange Rates

Exchange rates play a crucial role in determining how much your recipient ultimately receives. High street banks often include hidden margins of 2%–4%, and in some cases, even 3%–6%, above the mid-market rate. On the other hand, specialist providers usually charge much lower margins, typically between 0.3% and 1%.

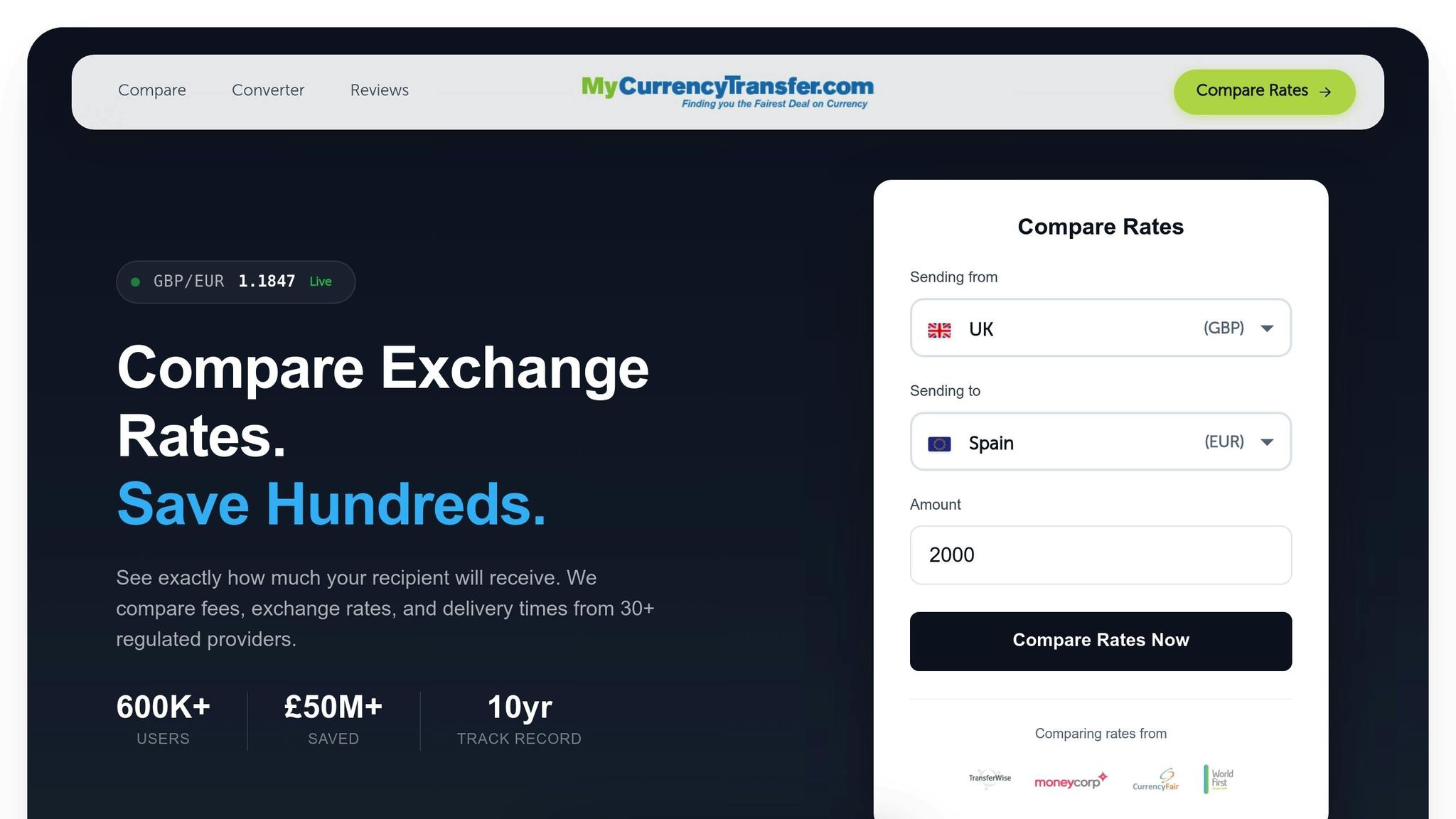

Real-Time Rate Comparison

Exchange rates are constantly shifting due to market demand and supply. A rate you check in the morning might not be the same by lunchtime. Platforms like MyCurrencyTransfer offer live comparisons of exchange rates from over 30 FCA-regulated providers. This lets you see exactly how much your recipient will receive after all fees and margins are factored in.

For example, in January 2025, a Which? Money comparison looked at sending £1,000 from the UK to Australia. Revolut provided the best deal, with the recipient receiving $1,984 AUD, while Moneygram offered significantly less at $1,916 AUD – a $68 difference purely due to rate variations.

When comparing providers, focus on the final amount your recipient will receive rather than just advertised fees. A provider claiming "no fees" might still add a 2%–3% margin to the exchange rate, which could end up costing you more than a provider with a small upfront fee but tighter margins. For instance, transferring £10,000 through a specialist provider instead of a bank could save you an average of £247. For larger transactions – like an £80,000 property purchase in Australia – the savings could be as much as £1,560.

Next, let’s delve into how rate margins can further influence the amount your recipient actually receives.

Understanding Rate Margins

The exchange rate margin is the difference between the mid-market rate (the rate banks use to trade currency) and the rate offered to you. This hidden markup is often the largest cost of any international transfer. To ensure you’re getting a fair deal, compare the provider’s rate against the current mid-market rate using an independent currency converter before proceeding.

"For larger transactions, such as buying property abroad, even a slight change in the exchange rate can make a significant difference to the value of your money." – Michael Brown, The Times

Always check the exchange rate right before sending your money, as rates can change quickly. Additionally, the size of your transfer can impact the margin applied – larger amounts often qualify for better rates. MyCurrencyTransfer’s comparison tool takes these factors into account, helping you calculate the exact amount your recipient will receive based on the size of your transfer.

2. Understand Transfer Fees

When sending money internationally, transfer fees can significantly impact how much your recipient ultimately receives. These fees come in different forms. Some providers charge a fixed fee – for instance, around €3 per transaction – regardless of the amount you send. Others use percentage-based fees, which increase as your transfer amount grows. For example, a 5% fee on £100 is £5, but on £1,000, it jumps to £50.

Many providers also combine an upfront fee with an exchange rate margin, which means the advertised fee isn’t the full story. Even so-called "fee-free" providers often apply an exchange rate margin of 3–6%, which can make your transfer more expensive overall. To truly understand the cost, it’s essential to calculate both the fees and the exchange rate margin. Next, let’s explore how hidden fees can further affect your transfer.

Avoiding Hidden Fees

Hidden fees, like exchange rate markups, can quietly reduce the amount your recipient receives. These markups are often the biggest hidden cost. For example, in a comparison from September 2022, sending £1,000 to France yielded very different results depending on the provider. One charged an upfront fee of about £4.28, delivering approximately 1,144.97 EUR to the recipient. Another, advertising as "no fee", delivered only around 1,108.38 EUR – a difference of roughly £36.59, entirely due to the exchange rate margin.

"Even if they advertise themselves as fee-free, providers will almost always apply a less favourable exchange rate than the one they receive themselves, in order to make a profit." – Faye Lipson, Senior Researcher & Writer, Which? [6]

Some services, like MyCurrencyTransfer, display the "recipient gets" figure upfront, showing the exact amount your recipient will receive. This transparency can help you avoid unexpected deductions, such as intermediary bank charges within the SWIFT network, which can reduce the final amount without warning. With this in mind, let’s break down the different fee structures to help you choose the most economical option.

Breakdown of Fee Structures

The right fee structure depends on how much you’re transferring. Flat fees and percentage-based fees each have their pros and cons. Flat fees tend to work better for larger transfers. For example, a €3 fee on a £5,000 transfer is negligible, but the same €3 fee on a £100 transfer becomes a significant percentage. On the other hand, percentage-based fees grow more expensive as the transfer amount increases. A 2% fee on £10,000 costs £200, while a flat fee of £5 would be far cheaper.

Traditional banks are often the most expensive option, as they usually charge high flat fees and add exchange rate margins of 3%–6%. In contrast, specialist online providers generally offer much lower margins – usually between 0.45% and 0.52% – and some foreign exchange brokers waive transfer fees entirely for amounts over £3,000. To get the best deal, compare the total cost across multiple providers on the same day. Exchange rates fluctuate frequently, and even small changes can significantly affect the final amount.

3. Verify Recipient’s Banking Details

After checking exchange rates and fees, ensuring the recipient’s banking details are correct is critical to making sure your funds arrive safely. Even minor errors can lead to delays, misdirected funds, or additional fees. If a transfer is returned due to incorrect details, the amount received may be reduced due to bank charges and exchange rate changes. It’s essential that the recipient’s name matches the bank account records exactly – something as small as a misspelling can trigger security alerts or cause the payment to be returned.

Different countries often have unique requirements for local banking codes in addition to international identifiers. For example, sending money to the United States requires a 9-digit Routing Number (ABA), while Australia uses a BSB code, and India relies on an IFSC code. Additionally, some banks may request a "reason for payment" to comply with anti-fraud regulations, so having this information ready can help avoid unnecessary delays.

Key Details to Verify

Before you initiate the transfer, double-check the following information with your recipient:

- Eurozone Transfers: Full name, IBAN, and BIC/SWIFT code.

- USA Transfers: Name, address, 9-digit ABA Routing Number, and account number.

- Australia Transfers: Name, bank name, account number, and BSB code.

- India Transfers: Name, account number, and IFSC code.

You can use online tools to validate IBAN and BIC/SWIFT codes. An IBAN can contain up to 34 alphanumeric characters, including a country code, check digits, and a bank identifier; the two digits after the country code act as a checksum to verify accuracy. In some cases, you may also need to provide the full address of the recipient’s bank branch along with the SWIFT code.

Taking the time to verify these details helps prevent errors and ensures a smoother transfer process.

Common Mistakes to Avoid

Even when details are verified, mistakes can still happen. A common error is entering both the account number and the IBAN in the same field. Since the IBAN already includes the account number, this can delay the payment as the beneficiary bank may need to manually correct the error. Data entry errors like this have resulted in millions of misdirected payments.

Other frequent mistakes include mismatching the sort code and account number, misspelling the recipient’s name, or leaving out the recipient’s full address. Even a single incorrect digit can send your money to the wrong account. Additionally, make sure the recipient’s bank account can accept the currency you’re sending – if not, the payment may be rejected.

4. Check Delivery Times

After confirming the recipient’s details, the next step is understanding how quickly your money will reach its destination. Transfer speeds can differ based on the route, provider, and payment method you select.

Here’s a closer look at the factors influencing delivery times and what to expect.

Factors Affecting Speed

The delivery time for your transfer often depends on the currency corridor. For example, transfers within the SEPA (Single Euro Payments Area) usually take just one working day. On the other hand, global transfers using the SWIFT network can take anywhere from 1 to 5 business days, as they often involve multiple intermediary banks. Traditional banks using SWIFT tend to be slower compared to specialist providers that utilise local payment networks.

Timing also plays a crucial role. Banks process transactions during their local business hours and typically have cut-off times between 2:00 PM and 5:00 PM. If you miss this window or account for time zone differences, your transfer might not be processed until the next business day. Additionally, bank holidays, public holidays, and even religious holidays in both the sending and receiving countries can cause delays. Keep in mind that workweeks vary in some countries – for instance, Egypt’s workweek runs from Sunday to Thursday.

Regulatory checks can also impact speed. Countries with strict financial regulations or stringent anti-money laundering procedures may hold transfers for further compliance reviews, particularly for larger amounts.

Delivery Time Estimates

Some providers, like MyCurrencyTransfer, offer upfront delivery time estimates, making it easier to plan time-sensitive transfers. For instance, Moneycorp has been known to deliver large transfers from the UK to Australia within just one working day. Between January and March 2025, Wise reported that 95% of its transfers were completed in less than 24 hours, with 64% arriving almost instantly – within 20 seconds.

To avoid delays, initiate your transfer early in the day and week to meet cut-off times and skip weekend interruptions. Be mindful of destination country holidays, and consider using specialist providers that offer real-time tracking for added convenience.

5. Check Provider Security and Regulation

Once you’ve confirmed delivery times, the next step is to ensure your chosen provider complies with UK financial regulations. This is crucial for safeguarding your transfer under strict regulatory oversight, which helps reduce potential risks.

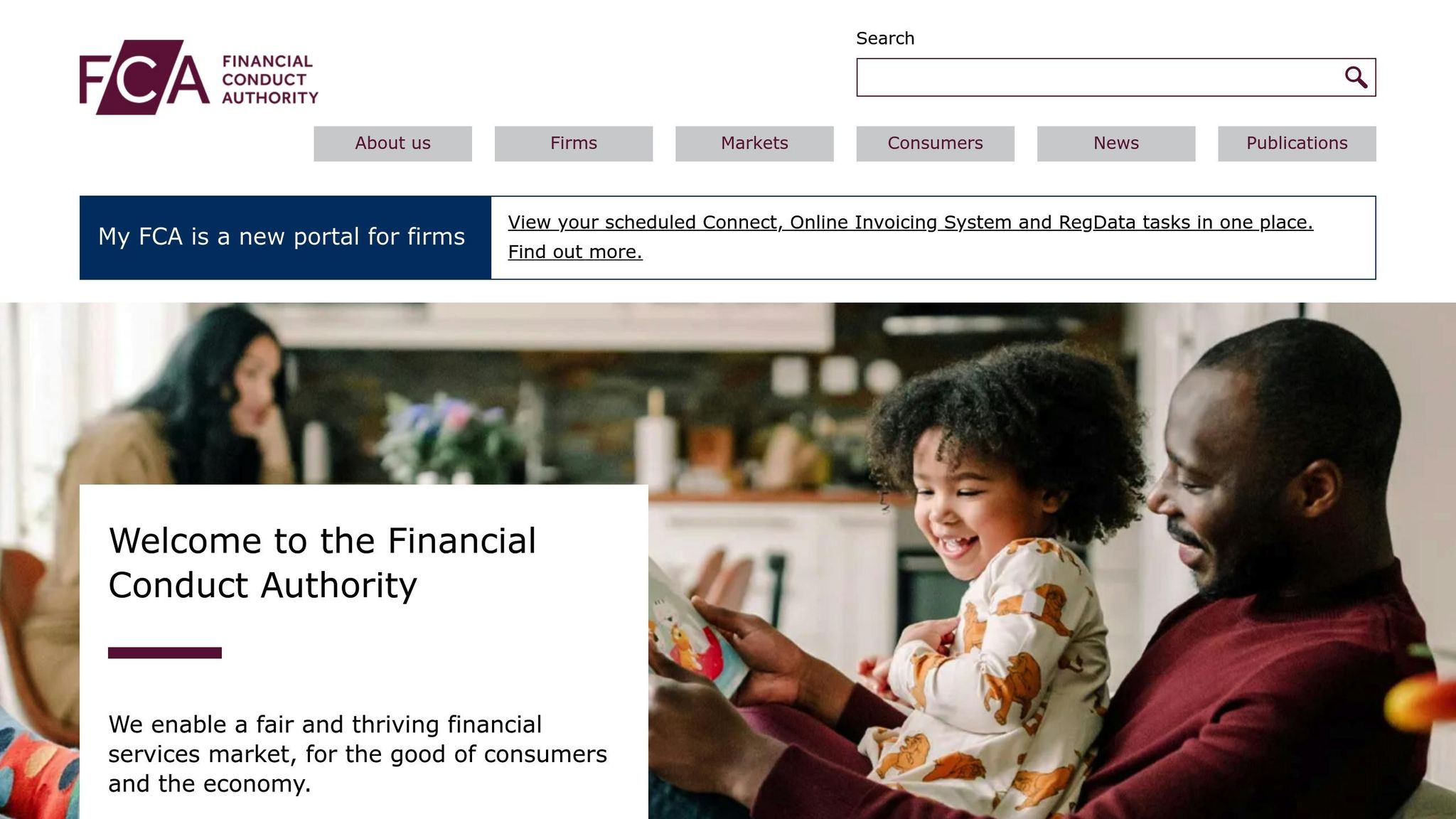

FCA Regulation and Client Fund Protection

In the UK, the Financial Conduct Authority (FCA) regulates money transfer providers. These firms fall into two categories: "authorised" and "registered." Authorised providers must meet higher standards, including keeping client funds separate from their business accounts. This means that even if the provider encounters financial trouble, your money is protected and should be returned to you. On the other hand, registered firms only need to demonstrate they are UK-based and have directors with clean financial records. They are not required to segregate client funds.

"Authorised firms keep your money separate from their own accounts, so your savings should be returned to you, even if the company goes under." – Equifax

To confirm your provider’s status, check the FCA’s Financial Services Register. Look for firms listed as "Authorised" with permissions for payments, e-money services, or money transfers. Choosing an authorised provider not only protects your funds but also gives you access to the Financial Ombudsman Service for dispute resolution after eight weeks.

Trusted Providers on MyCurrencyTransfer

MyCurrencyTransfer takes the hassle out of verifying providers. The platform exclusively partners with over 30 FCA-regulated firms, each thoroughly checked for security and compliance. With more than 600,000 users relying on the service, MyCurrencyTransfer lets you compare real-time exchange rates confidently, knowing every option meets UK financial standards for protecting client funds.

sbb-itb-0f86db3

6. Consider Transfer Amount Limits

Once you’ve ensured your provider is secure, the next step is to check their transfer limits. While there are no legal restrictions in the UK on how much money you can send overseas, individual providers set their own daily or per-transaction caps. For example, high-street banks often limit transfers to amounts between £25,000 and £50,000 per day. On the other hand, specialist providers can handle much larger sums.

It’s also worth noting that transfers over £10,000 are classified as "large transfers" and may draw closer scrutiny from HMRC and the FCA to ensure compliance with anti-money laundering regulations. To avoid delays, it’s a good idea to have Source of Funds documentation ready, such as property sale contracts, recent payslips, or grants of probate. Being prepared with these documents can help speed up the process when you’re ready to send a large sum.

Managing Large Transfers

If you’re planning to send over £3,000, using a specialist foreign exchange (FX) broker can save you money. These brokers often waive transfer fees and provide better exchange rates compared to traditional banks. For example, in August 2025, a £20,000 transfer to the US cost £71.64 with one provider, while another charged rates that reduced the recipient’s amount by more than $670.

When dealing with large sums, it’s wise to make a small test payment first to confirm the recipient’s details. Keep in mind, larger transfers may still require you to go through a detailed compliance process and submit additional paperwork. Some providers also offer perks like volume discounts or dedicated support teams for high-value transactions, making the process smoother. However, don’t overlook how flat fees can significantly impact smaller transfers.

Small Transfer Fees

For smaller transfers, flat fees can quickly add up. Research shows that 57% of international transfers are for amounts under £1,000. If your provider charges a flat fee – say £15 on a £200 transfer – that’s a hefty 7.5% of the total amount. In contrast, the same flat fee on a £5,000 transfer would only amount to 0.3%. Providers like CurrencyFair charge a flat fee of €3 no matter the amount [8], which can be a more cost-effective option for smaller transactions. Additionally, check whether the recipient’s bank charges extra fees. For instance, Barclays applies a £6 fee for international payments over £100.

7. Review Payment Methods

How you fund your transfer can significantly impact both the cost and the speed of delivery. It’s worth noting that your bank may not always be the most cost-effective option. Traditional banks often add a margin of 3% to 6% on top of the mid-market exchange rate.

Bank Transfer vs. Debit/Credit Cards

Bank transfers are a reliable choice, especially for larger amounts. However, international bank transfers can take anywhere from 1 to 5 working days to process. Even transfers advertised as "fee-free" may involve deductions by intermediary banks along the way.

Debit cards allow for instant funding but come with higher fees. Credit cards, while fast, are often the most expensive option due to cash advance charges. Also, keep in mind daily spending limits – if you’re transferring a large sum, you might need to split it into smaller transactions.

The best method for you will depend on the size of your transfer and how quickly you need the funds to arrive.

Choosing the Right Method

For larger transfers, using a bank transfer through a specialist provider is often the most cost-effective route. These providers bypass the traditional SWIFT network, opting for local payment systems instead. This approach not only reduces costs but also speeds up delivery times. Some specialist services can even complete transfers almost instantly.

If speed is your main concern, debit cards or digital wallets like PayPal can deliver funds to the recipient quickly. However, digital wallets often apply higher currency conversion markups. For smaller transfers, especially those under £1,000, it’s smarter to go with providers that charge low flat fees rather than percentage-based ones. This ensures more of your money reaches the recipient.

Choosing the right funding method works hand in hand with securing competitive exchange rates and low fees, reinforcing the strategies outlined earlier in this guide.

8. Confirm Currency Support

When it comes to transferring money internationally, confirming that your chosen service supports the required currency is a crucial step. Overlooking this can lead to delays or even failed transactions. Not all providers cater to every currency or destination, so verifying this in advance ensures a smoother process.

Checking Available Currency Corridors

MyCurrencyTransfer allows users to convert GBP into over 100 currencies through partnerships with more than 30 FCA-regulated providers. Its homepage features a real-time comparison tool where you can input your sending country, destination country, and transfer amount to instantly see which providers support your specific route.

If your desired destination isn’t immediately listed, you can use the "View all countries" link or the "Send Money to Any Country" search tool to explore availability. The platform is particularly well-suited for popular UK transfer routes, including Spain, France, the USA, Australia, and India. Since provider availability can change, it’s a good idea to request a quote right away. This simple step ensures you won’t run into "unsupported currency" errors mid-transfer.

Avoiding Currency Conversion Issues

Assuming that a provider supports your desired currency when it doesn’t can lead to unnecessary complications, such as poor conversion rates or outright payment rejection. To avoid this, filter for providers that explicitly support your target currency when comparing services. This not only saves time but also prevents the recipient’s bank from applying costly secondary conversions if they receive an unsupported currency.

MyCurrencyTransfer simplifies this process by offering real-time comparisons of rates and fees from over 30 FCA-regulated providers. You’ll know exactly how much your recipient will receive, eliminating guesswork and ensuring transparency.

"Banks have hidden billions in unfair exchange rate margins for decades. We’re here to change that." – MyCurrencyTransfer

Conclusion

Sending money internationally doesn’t have to be complicated or expensive. By following these eight essential checks – like comparing exchange rates, understanding fees, verifying recipient details, and confirming security – you can avoid unnecessary costs and ensure your funds arrive safely and on time. These steps are not just practical; they’re essential for a smooth and reliable transfer process.

When it comes to fees, the difference is clear. Banks often include hidden costs with higher margins, while specialised services offer much lower rates, saving you significant amounts over time – especially for frequent or large transfers.

Platforms like MyCurrencyTransfer simplify the process by bringing together over 30 FCA-regulated providers. Completely free to use, it has helped over 600,000 users save money on their transfers over the past decade. One satisfied user shared:

"MyCurrencyTransfer.com saved me over £1000 on a recent transfer to the US." – Helen B, Multi-National Employee Overseas.

With all providers vetted for FCA regulation and client fund protection, you can trust that your money is handled securely. Despite the potential savings, only 11% of people compare transfer costs when sending money abroad. Taking just a few minutes to compare providers could save you a substantial amount. Why not see for yourself? Compare your options today and make your next transfer with confidence.

FAQs

How can I make sure I’m getting the best exchange rate when sending money abroad?

To secure the best exchange rate for your international transfer, it’s essential to do some groundwork – compare rates, consider fees, and choose the right time to send your money.

Start by checking exchange rates from several reliable providers. Use the mid-market rate as your benchmark. This rate reflects how banks trade currencies with each other, and the closer a provider’s rate is to it, the less you’ll lose to hidden costs. Don’t forget to account for transfer fees, as a slightly better exchange rate might not save you money if the fees are higher. Always calculate the total cost, including both the rate and fees, to find the most economical option.

Timing your transfer can also make a big difference. Exchange rates often shift during significant economic events, like updates from the Bank of England. These periods of volatility can work against you, so it’s wise to avoid transferring money during such times, if possible. By staying informed and keeping these tips in mind, you can make your transfer both cost-effective and straightforward.

What should I do if my money transfer is delayed or sent to the wrong account?

If your transfer hasn’t arrived on the expected date or appears to have gone to the wrong recipient, it’s crucial to get in touch with MyCurrencyTransfer right away. Acting promptly can help sort out the issue more quickly. Make sure to provide all the necessary details, including your name, contact information, the amount transferred, the date the funds were due, the recipient’s details, and any reference numbers from your receipt.

Under UK consumer protection regulations, you have up to 180 days from the promised delivery date to report a problem. Once you notify MyCurrencyTransfer, they will investigate the situation and update you on the findings. If they confirm an error – such as a delay, incorrect amount, or funds sent to the wrong recipient – they will take corrective action to ensure the money reaches the right person.

While waiting for a resolution, it’s a good idea to keep a record of all correspondence and any relevant documents, like bank statements or transfer confirmations. If the issue remains unresolved, you can escalate it to the Financial Ombudsman Service for further support.

Why is it crucial to double-check the recipient’s banking details before sending money abroad?

Accurate banking details are essential when transferring money. Ensuring that the recipient’s full name, account number, sort code, IBAN, and BIC/SWIFT code are correct can prevent costly errors. Even a minor mistake might cause delays, incur extra fees, or, worse, result in your funds being sent to the wrong account.

By carefully reviewing these details, you improve the chances of your payment navigating the international banking system smoothly and reaching the right destination on time. It also helps you meet anti-fraud and regulatory standards, offering both security and peace of mind during the transaction process.