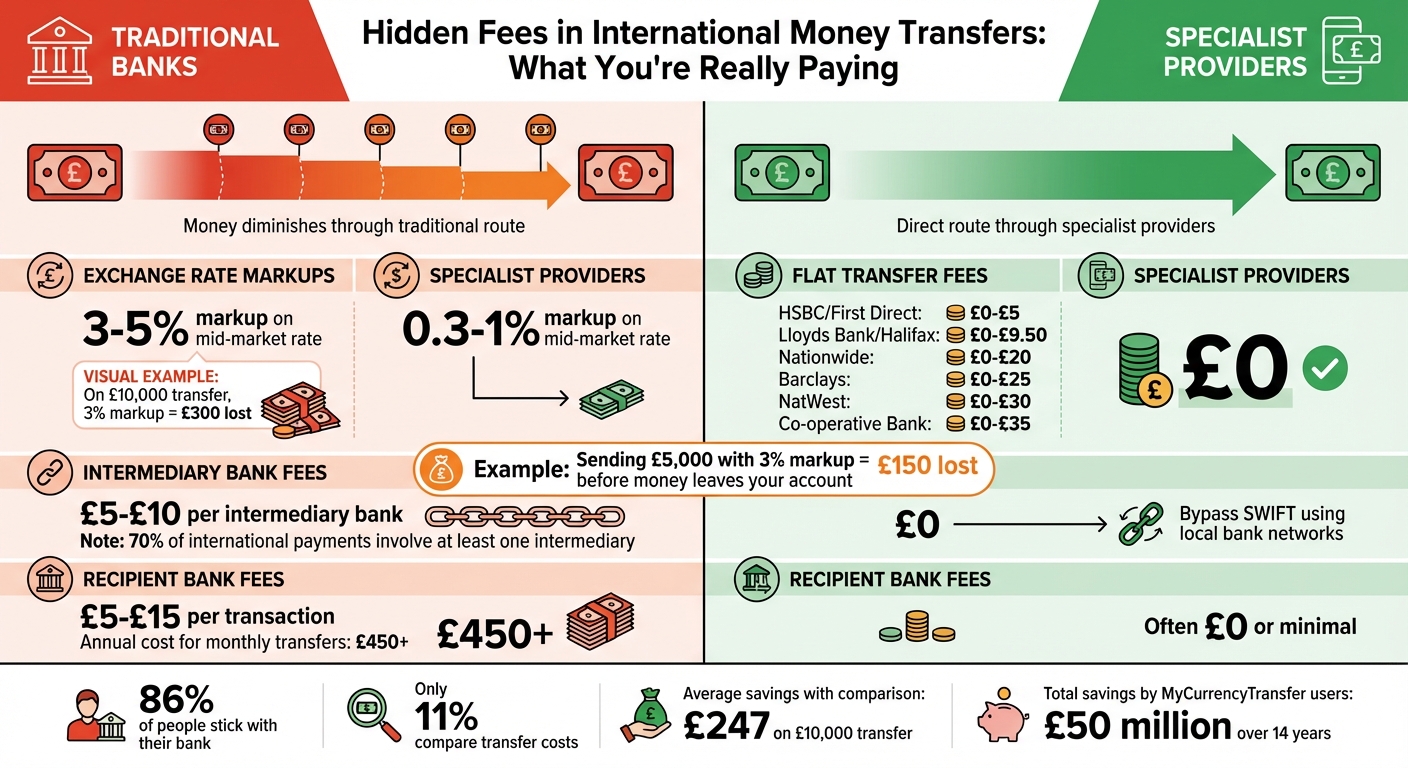

Sending money internationally often costs more than expected due to hidden fees like exchange rate markups, flat transfer fees, and intermediary bank charges. Many people unknowingly lose money because they rely on their main bank without comparing options. For example, banks often add a 3–5% markup to exchange rates, charge fixed fees up to £35, and deduct intermediary fees along the way. These costs can significantly reduce the amount your recipient receives.

Here’s how to avoid these fees:

- Compare providers: Use tools like MyCurrencyTransfer to find the best rates and lowest fees.

- Check the mid-market rate: Compare the rate offered to the actual exchange rate on Google.

- Avoid SWIFT fees: Choose providers that bypass intermediary banks by using local bank networks.

- Be aware of flat fees: Some banks charge up to £30 per transfer, while specialist providers often charge none.

Hidden Fees in International Money Transfers: Banks vs Specialist Providers Comparison

Western Union Money Transfer | 5 Hidden Fees AND Tricks To Reduce Charges

Common Hidden Fees in Money Transfers

When sending money internationally, the advertised costs often don’t tell the full story. Hidden fees can eat into the amount your recipient ultimately receives, so understanding these charges is crucial.

Exchange Rate Markups

One of the biggest hidden costs comes from exchange rate markups. Banks and transfer providers usually add a margin to the mid-market rate – the actual rate you’d find on Google. This margin often ranges between 3% and 5%[3].

"The exchange rate offered by banks is often marked up, meaning it’s less favourable than the mid-market rate you might see on Google… This markup can range between 3% to 5%, making it one of the most significant hidden costs." – Sam Eckford, Website Content Writer, OFX[3]

Let’s say you’re transferring £5,000 with a 3% markup. You’d lose about £150 right off the bat, even before the money leaves your account[6].

Flat Transfer Fees

In addition to exchange rate markups, banks usually charge flat fees for processing international transfers. These fees vary by bank and transfer method, with high-street banks in the UK charging anywhere from £5 to £35 per transaction[3].

| Provider | International Transfer Fee |

|---|---|

| HSBC / First Direct | £0 to £5 |

| Lloyds Bank / Halifax | £0 to £9.50 |

| Nationwide | £0 to £20 |

| Barclays | £0 to £25 |

| NatWest | £0 to £30 |

| The Co-operative Bank | £0 to £35 |

Some banks also adjust fees based on destination. For example, Lloyds Bank charges £12 for transfers to Zone 1 countries (like sending money to the USA, Canada, and Europe) but £20 for Zone 2 countries (the rest of the world)[3]. NatWest, on the other hand, may add an extra £15 for urgent transfers compared to standard ones[3].

Intermediary and Recipient Bank Fees

If your transfer goes through the SWIFT network, intermediary banks often deduct fees along the way. Each bank in the chain usually takes £5 to £10, and this happens without prior notice[3][5]. On top of that, the recipient’s bank typically charges its own processing fee, which can range from £5 to £15[3].

"The sender is not informed that intermediary bank fees may reduce the amount received by the recipient, which can lead to unexpected shortfalls." – Financial Conduct Authority[4]

These deductions can add up as funds pass through multiple banks. For regular transfers, these costs can become especially burdensome. For example, UK banks charge receiving fees between £2 and £7.50 per transaction. If you’re making monthly transfers, this could total over £450 annually[1].

The combined impact of intermediary and recipient bank fees highlights the importance of understanding the full cost of your transfer. For more tips on saving, visit our international money transfer blog.

Why Hidden Fees Go Unnoticed

Many people trust their bank to offer the best deal for international transfers. However, while some providers advertise "zero-fee" or "no-commission" transfers, they often conceal costs in the form of marked-up exchange rates [3] [4]. This practice largely goes unnoticed because of consumer habits – 86% of people stick with their bank, and only 11% take the time to compare transfer costs [2]. As a result, many unknowingly end up paying more than they should.

Mid-Market Rate vs. Marked-Up Rates

One major reason hidden fees slip under the radar is that most people don’t check the mid-market rate. If you search "GBP to USD" on Google, you’ll see the mid-market rate – the actual exchange rate used in global currency markets and between banks. However, the rate you’re offered by banks or providers is often far from this benchmark [1] [3].

Banks usually add a markup of 3% to 5% on top of the mid-market rate, and this markup becomes an additional profit for them [3]. Since most consumers don’t compare the offered rate to the mid-market rate, they have no way of recognising this hidden fee. The Financial Conduct Authority highlights this issue, stating that "where the consumer is not clearly informed that the firm’s exchange rate differs from the reference rate, it may lead to misunderstandings about the actual cost" [4].

What makes this even trickier is that these hidden costs never appear as a separate line item on your transaction receipt. They’re buried in the exchange rate itself.

How SWIFT Network Fees Work

The SWIFT network operates much like connecting flights for your money. When your bank doesn’t have a direct relationship with the recipient’s bank, the transfer is routed through several intermediary banks before it reaches its destination [5].

Here’s the catch: while your bank might disclose the upfront transfer fee, they rarely inform you about the deductions made by intermediary banks. These banks quietly take their share as your money moves through the system. By the time it arrives, the recipient often gets less than expected [4].

This isn’t a rare occurrence – over 70% of international payments involve at least one intermediary bank. In fact, the top five intermediary banks handle around 40% of global cross-border transactions [7]. Despite this, most senders remain completely unaware of these deductions until the transaction is complete.

Understanding these hidden fees is the first step to discovering how MyCurrencyTransfer can help you avoid them. For example, you can compare CAD to USD rates to see how much you could save on larger transfers.

sbb-itb-0f86db3

How to Avoid Hidden Fees with MyCurrencyTransfer

Now that you know how hidden fees operate, let’s explore how to steer clear of them altogether. With MyCurrencyTransfer, you can see the exact amount being sent and received before making your transfer.

Compare Real-Time Rates and Fees

MyCurrencyTransfer pulls live rates and fees from over 30 FCA-regulated providers using APIs [10]. There’s no need to sign up or create an account – simply enter your transfer amount, and you’ll get an instant side-by-side comparison of what each provider offers.

The platform ranks providers based on one straightforward metric: the final amount that reaches your recipient’s account [11]. This means you’re not comparing flashy advertised rates or so-called “zero-fee” claims. Instead, you’re seeing the actual pounds and pence (or euros, dollars, etc.) that will land in the recipient’s account after all fees and markups are applied.

Over 600,000 users have taken advantage of this comparison tool, collectively saving an estimated £50 million in fees over the platform’s 14-year history [10]. On average, users save around £247 on a £10,000 transfer compared to traditional banks [10]. By providing a clear view of live rates, the platform ensures transparency in every transaction.

Check for Transparent Exchange Rates

One of the easiest ways to spot hidden fees is by comparing the mid-market rate. A quick search for "GBP to USD" on Google will show you the actual interbank rate. MyCurrencyTransfer reveals how each provider’s rate stacks up against this benchmark.

High-street banks often add margins of 2% to 4% on top of the mid-market rate [10]. In contrast, specialist providers listed on MyCurrencyTransfer offer much smaller margins, typically between 0.3% and 1% [10]. This difference can quickly add up. For example, on a £10,000 transfer, a 3% markup means £300 disappears into the exchange rate – money you could have saved.

"Banks have hidden billions in unfair exchange rate margins for decades. We’re here to change that." – MyCurrencyTransfer [11]

Only providers that are upfront about their pricing are listed on the platform. If a provider hides costs, they won’t make the cut [11]. Next, let’s look at how to avoid additional fees altogether.

Avoid Intermediary and Flat Fees

Traditional transfers often come with extra charges, but MyCurrencyTransfer helps you avoid these by connecting directly with local bank accounts. Banks typically charge flat fees of £10 to £40 per transaction [10], and intermediary banks can add even more costs along the way. On top of that, recipient banks may charge another £5 to £15 for processing incoming funds [3].

Specialist providers on MyCurrencyTransfer often charge £0 in flat fees [10]. Many also bypass the SWIFT network entirely, instead using global networks of local bank accounts. This direct approach ensures your money moves straight from the UK to your recipient’s country without passing through multiple intermediary banks.

Take James T., for example. He saved over £400 on a £50,000 transfer to Spain [10]. Similarly, Sarah M. praised the “live rate comparison” feature, which she found essential for securing better rates on regular transfers to India [10].

Use Fee Calculators for Full Cost Visibility

Before committing to any transfer, take advantage of MyCurrencyTransfer’s real-time fee calculator. Just enter your transfer amount, select your source and destination countries, and the calculator will show you the exact amount your recipient will receive [10]. This “Total Cost” approach factors in everything: exchange rate margins, transfer fees, and any payment method surcharges [10].

"Our comparison engine ranks providers by one thing only: the amount that arrives in your recipient’s account." – MyCurrencyTransfer [11]

The service is completely free to use [11]. There are no hidden subscriptions, no catches, and no obligation to proceed with any provider. You get all the information you need to make an informed decision – and potentially save hundreds of pounds in the process. With this level of transparency, you’ll always know exactly how much your recipient will receive.

Step-by-Step Guide to Saving Money on Transfers

Here’s how to use MyCurrencyTransfer to find budget-friendly options for international money transfers.

Enter Transfer Details

Start by entering the amount you want to transfer (e.g., £5,000) and the destination country. The platform will instantly provide real-time quotes from over 30 FCA-regulated providers – no need to sign up or create an account. Make sure your details are accurate, as even small differences can affect the final cost. Rates are updated frequently to reflect market changes[8]. Once you’ve entered your details, you’re ready to compare provider quotes.

Compare Providers

Next, focus on the "Recipient Gets" amount. This figure shows how much money will actually reach your recipient after all fees and exchange rate markups are applied. To ensure you’re getting a fair deal, compare the exchange rate offered by the provider with the mid-market rate (the rate you see on Google). This will help you spot any hidden markups[9]. If your transfer isn’t urgent, consider using the standard 1–3 day delivery option instead of instant transfers – it could save you 30–50%[9]. Also, funding your transfer via bank transfer or debit card is often cheaper than using a credit card, which can add an extra 2–3% in fees[9]. Once you’ve found the best deal, you’re ready to move forward.

Select and Complete the Transfer

After reviewing your options, choose the provider that offers the highest "Recipient Gets" amount for your transfer. MyCurrencyTransfer is free to use, with no hidden subscriptions or commitments. Once you’ve made your choice, you’ll be redirected to the provider’s platform to complete the transfer securely. You’ll need to provide details such as the recipient’s full name, bank name and address, IBAN or account number, and the SWIFT/BIC code. Before finalising, double-check that all fees are clearly itemised to avoid any surprises. It’s worth noting that while 52% of UK consumers stick with their bank for international payments, only 11% take the time to compare costs for better deals[2]. Don’t let loyalty cost you more than it should!

Conclusion

Hidden fees can make international money transfers much more expensive than they seem at first glance. These charges might include exchange rate markups of 3%–5%, intermediary fees ranging from £5 to £10, and recipient fees that can reach up to £15[3]. These costs not only take a toll on your finances but also highlight a gap in consumer awareness. For instance, 52% of UK consumers stick with their banks out of habit, while only 11% actively compare costs. This lack of comparison can lead to unnecessary expenses – like a 4% markup on a £10,000 transfer, which adds an extra £400 to the cost[2][3].

MyCurrencyTransfer simplifies this process by letting you compare real-time rates and fees from over 30 FCA-regulated providers – without requiring you to sign up. Instead of focusing solely on upfront fees, their "Recipient Gets" figure shows exactly how much money will arrive at its destination. This transparency helps you spot providers that incorporate hidden costs into their exchange rates, enabling you to make better-informed decisions and ensure more of your money reaches its intended recipient.

"There is increasing backlash against financial institutions with opaque fee structures. Unless a foreign exchange provider specifically says it doesn’t charge transfer fees, you should make sure you’ve looked into how and what they charge."

– Mar Bonnin Palmer, Head of Partnerships, Moneycorp[1]

By understanding the true cost of your transfer, you can save money and take control of the process. Whether you’re sending £500 or £50,000, knowing how fees work allows you to choose providers that use local bank networks to bypass costly SWIFT intermediaries, offer exchange rates close to the mid-market rate, and provide full transparency on all charges[3][4]. Armed with this knowledge, you can make every pound you send work harder for both you and your recipient.

Take the time to compare your options, check the mid-market rate, and ensure your money goes further with every transfer.

FAQs

How can I spot and avoid hidden exchange rate markups when sending money abroad?

To steer clear of hidden exchange rate markups, start by checking the mid-market rate – this is the actual exchange rate banks use when trading currencies. You can find it on trusted platforms. Once you know the mid-market rate, compare it to the rate your chosen provider offers. The gap between the two reveals the markup you’re being charged. For instance, if the mid-market rate is £1 = €1.14 but your provider offers £1 = €1.10, the difference of €0.04 is their markup.

Opt for a provider that’s upfront about their rates and fees. The best services will clearly show the mid-market rate alongside their offered rate and break down any extra charges. This transparency helps you work out the real cost of your transfer before committing, so there are no unpleasant surprises.

It’s also a good idea to use a fee calculator to confirm the total cost. By comparing rates and fees before you finalise your transfer, you can keep costs down and avoid paying more than necessary.

Why are specialist providers often better than banks for sending money abroad?

Specialist money transfer providers often prove to be a more economical choice compared to high street banks. They typically charge lower, upfront fees and rely on the live mid-market exchange rate, applying only a small, clear fee. This ensures that a larger portion of your money reaches the recipient, unlike banks, which tend to add hidden markups to exchange rates and impose higher fees.

Another advantage is that these providers bypass intermediary bank fees by avoiding the traditional network of correspondent banks. Some even offer discounts for higher transfer amounts, such as transactions exceeding £20,000 within a month. With competitive rates, fewer hidden charges, and straightforward pricing, these providers offer a dependable way to cut costs on international money transfers.

How does the SWIFT network impact the cost of my money transfer?

The SWIFT network can make your money transfer more expensive because of extra fees imposed by the banks involved. These charges could come from the sending bank, intermediary banks, and the receiving bank, all for handling the SWIFT messages.

In addition to these fees, you might face exchange rate markups, which can push up the overall cost even more. To keep these expenses in check, it’s crucial to select a provider that clearly outlines all possible charges from the start.