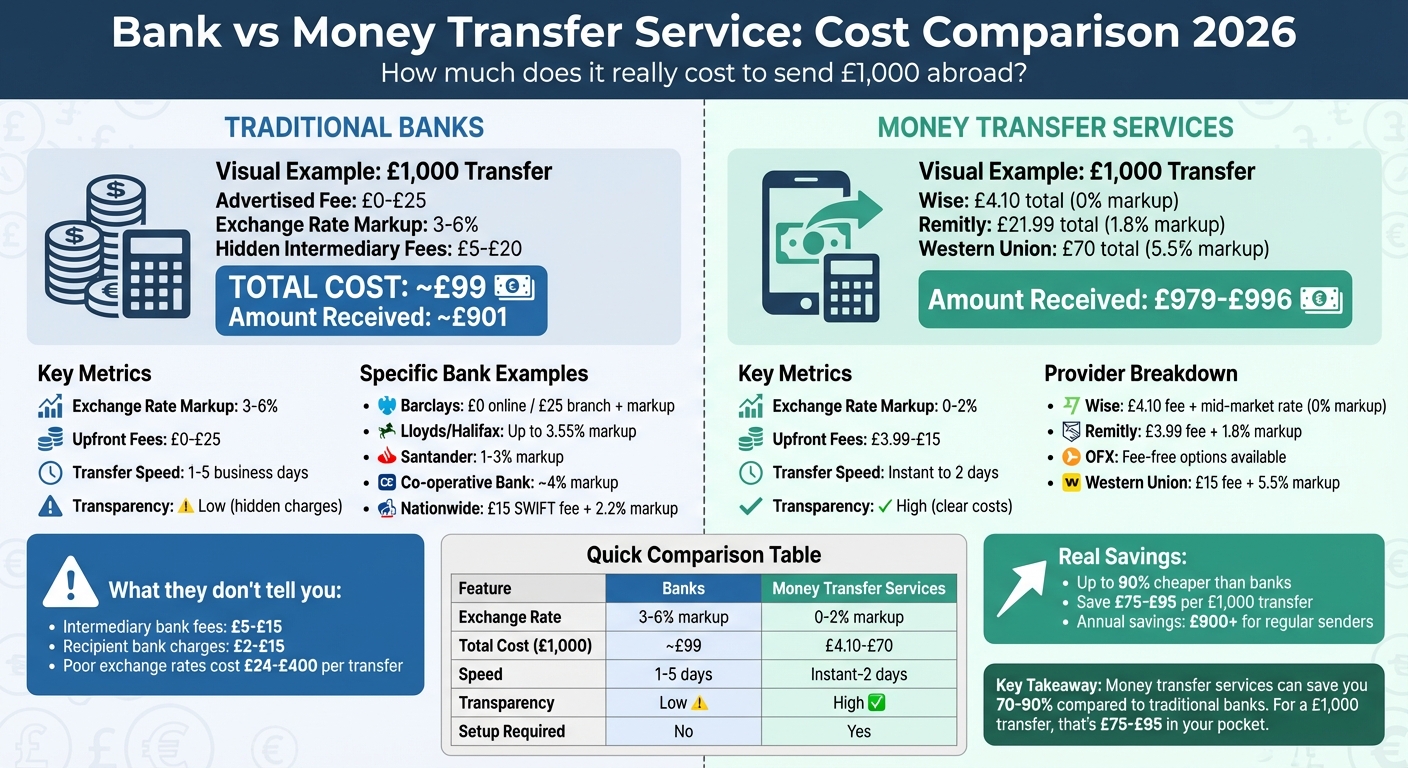

When sending money abroad, the choice between banks and money transfer services can make a substantial difference in cost. Banks often advertise "£0 fee" transfers, but hidden costs like exchange rate markups (3–6%) and intermediary fees (£5–£20) mean you could lose up to 10% of the amount sent. For example, transferring £1,000 through a bank might cost you £99 in total fees and markups.

Money transfer services, on the other hand, provide better transparency and lower costs. Providers like Wise charge as little as £4.10 for a £1,000 transfer, using the mid-market exchange rate with no markup. Even services with small markups, like Remitly (1.8%), are far cheaper than banks.

Key takeaway: Banks are convenient but expensive, while money transfer services offer significant savings – up to 90% cheaper in some cases.

Quick Comparison:

| Feature | Banks | Money Transfer Services |

|---|---|---|

| Exchange Rate Markup | 3–6% | 0–2% |

| Fees | £0–£25 upfront; hidden fees | £3.99–£15 upfront |

| Total Cost on £1,000 | ~£99 | £4.10–£70 |

| Transfer Speed | 1–5 business days | Instant to 2 days |

| Transparency | Low (hidden charges) | High (clear upfront costs) |

If saving money is your priority, using a specialist provider is the smarter choice. However, banks may still appeal to those who value simplicity and familiarity.

Banks vs Money Transfer Services Cost Comparison 2026

1. Banks

Fees

Many UK banks promote "£0 fee" transfers, especially for online transactions within Europe via SEPA. For instance, institutions like Barclays, HSBC, and NatWest often waive fees for these transfers. However, sending money outside the Eurozone can cost between £9.50 and £25 [2][3]. If you opt for an in-branch transfer, expect to pay more – Barclays, for example, charges £25 for branch-arranged transfers, compared to £0 for online ones [2][6].

The cost of transferring funds can also depend on the destination. Some banks use a zone-based pricing system, charging around £12 for transfers to North America or Europe, and up to £20 for other regions. Nationwide applies a flat fee of £15 for SWIFT payments, while the Co-operative Bank charges 0.25% of the transfer amount, capped at £35 [3]. Beyond these upfront costs, the recipient’s bank may deduct an additional £2 to £15 upon receiving the funds [2][5]. These varying fee structures often conceal hidden expenses that increase the overall cost of transferring money.

Exchange Rate Margins

Banks don’t just profit from fees – they also add a markup to exchange rates. UK high street banks typically add between 3% and 6% on top of the mid-market rate [1][2]. For example, on a £10,000 transfer, a 4% markup could cost you an extra £400 [2]. Specifically, Lloyds and Halifax apply markups of up to 3.55%, Santander charges between 1% and 3%, and the Co-operative Bank adds around 4%.

To put this into perspective, if you send £1,000 to Germany, Barclays might convert it to around 1,174 EUR. However, using the mid-market rate, the transfer would yield closer to 1,202 EUR – leaving the recipient £24 short, even though the transfer fee was advertised as "free".

"The banks rip you off with the fees. The margins they charge on foreign currency are crazy."

– Eric Eigner, Founder

Hidden Charges

In addition to upfront fees and exchange rate markups, intermediary and recipient banks often apply extra deductions. Intermediary banks may deduct fees during the transfer process, while the recipient’s bank typically charges a processing fee, usually between £5 and £15.

Some banks also have less obvious charges. For instance, Barclays might add a £3 "USD cover charge" for certain dollar transactions. If you want to track your payment, you could face additional costs in the form of a tracer fee.

| Bank | Online Transfer Fee | Branch Fee | Exchange Rate Markup |

|---|---|---|---|

| Barclays | £0 | £25 | Varies |

| Lloyds/Halifax | £0 (EUR) / £9.50 (Other) | £25 | Up to 3.55% |

| Nationwide | £15 (SWIFT) | Varies | 2.2% |

| Santander | £0 (EUR) / £25 (Other) | Varies | 1% to 3% |

| Co-operative Bank | 0.25% (Max £35) | Varies | ~4% |

For a typical £1,000 transfer, these costs can add up quickly. You might pay around £35 in upfront fees, alongside an effective exchange rate markup of about 6.4%, bringing the total cost to roughly £99.

sbb-itb-0f86db3

2. Money Transfer Services

Fees

Specialist money transfer services generally offer lower fees, either as a small fixed amount or a low percentage of the transfer total. For instance, Wise charges approximately 0.41% of the transfer amount with no additional markup, while Remitly applies a fee of about £3.99 for standard transfers. Some providers, like CurrencyTransfer, even offer fee-free transfers for specific currency pairs or larger amounts.

To keep costs down, funding transfers via bank transfer is recommended. However, if you choose to pay with a credit or debit card, expect an additional 2–3% fee.

That said, the real cost difference often lies in the exchange rate markups.

Exchange Rate Margins

One of the biggest advantages of specialist money transfer services is their competitive exchange rates. Wise, for example, uses the mid-market rate with no markup at all, while Remitly applies an approximate 1.8% markup. On the other hand, services like Western Union typically add a markup ranging from 3% to 6%. This is a stark contrast to the higher markups often imposed by traditional banks.

Let’s break it down: if you were transferring £1,000 to euros, Wise’s total cost might be around £4.10. For the same transfer, Remitly’s cost would be about £21.99, Western Union’s roughly £70, and a traditional bank could charge as much as £99 [1]. In one instance, a travelling copywriter named Scott shared that he saved nearly NZ$7,000 in 2024 by using OFX instead of his bank. He also noted that the service was not only cheaper but faster as well.

Hidden Charges

While fees and exchange rate markups make up the bulk of transfer costs, there are a few hidden charges that could impact the final amount received. The most notable is the exchange rate markup itself – a 2% margin adds an extra £20 for every £1,000 sent. Services that advertise "no fees" or "0% commission" often compensate for this by offering less favourable exchange rates, so it’s crucial to focus on the total amount your recipient will actually receive by using an international money transfer comparison.

Opting for express transfers can also increase costs by 30–50% compared to standard transfers, which typically take 1–3 days. Additionally, while specialist providers usually sidestep intermediary bank fees by leveraging networks of local accounts, it’s still wise to check if the recipient’s bank charges any fees for processing incoming international payments [1].

| Service | Typical Fee | Exchange Rate Markup | Total Cost on £1,000 Transfer |

|---|---|---|---|

| Wise | ~£4.10 | 0% | ~£4.10 |

| Remitly | ~£3.99 | ~1.8% | ~£21.99 |

| Western Union | £15.00 | ~5.5% | ~£70.00 |

International Money Transfers: Wire Transfers vs Cheaper Alternatives Explained

Pros and Cons

Deciding between a traditional bank and a specialist money transfer service ultimately depends on your priorities. Each option has its own set of perks and drawbacks, which can influence the cost and overall experience. Below is a closer look at the key differences to help you make an informed choice.

Banks are convenient and familiar. If you already have an account, you can skip the hassle of setting up something new. Banks often allow higher transfer limits, especially for in-branch transactions, and within the Single Euro Payments Area (SEPA), Euro-to-Euro transfers are often low-cost or even free. However, this convenience comes with a catch: banks typically add hidden fees and markups, which can significantly reduce the value of your transfer.

Specialist money transfer services focus on affordability and speed. These providers often use the mid-market exchange rate or apply minimal markups (usually 0% to 2%), with fees that are transparent and clearly stated upfront. Transfers are generally faster, taking one to two days compared to the one to five business days common with banks. However, using these services means you’ll need to create a new account and go through identity verification, which might feel like extra work if you’re used to the simplicity of your bank. Transfer limits can also be lower, though many providers offer tailored support for larger amounts. These features make specialist services an appealing option for cost-conscious users, as discussed earlier.

| Feature | Traditional Banks | Money Transfer Services |

|---|---|---|

| Exchange Rate | Marked up (3–5%) | Mid-market or near mid-market |

| Transfer Speed | 1–5 business days | Instant to 2 business days |

| Transparency | Low (hidden fees) | High (clear upfront costs) |

| Convenience | High (existing account) | Moderate (new setup required) |

| Transfer Limits | Very high (unlimited in-branch) | Variable (capped per transfer) |

| Customer Support | Branch, phone, online | Online/app (some phone support) |

This table highlights the trade-offs between the convenience of banks and the cost efficiency of specialist services.

Key takeaway: Specialist providers can save you 70% to 90% compared to traditional bank wires. If you send money frequently or want the best exchange rate, a specialist service is typically the smarter choice. That said, if you prioritise simplicity and prefer keeping everything under one roof, sticking with your bank might still make sense – even if it costs more.

Conclusion

By 2026, the cost differences in international money transfers are striking. Specialist services can be up to 90% cheaper than traditional bank transfers, with the gap often widening for larger amounts. For instance, sending £500 from the UK to Germany could cost around £4.43 with a specialist provider, compared to £30.15 with a high-street bank – a difference of approximately £25.72.

Hidden fees also play a big role. While some banks, like NatWest, may advertise no upfront fees, their exchange rate markups can significantly inflate the overall cost. On the other hand, providers using the mid-market rate offer clear and upfront pricing. For smaller amounts, the contrast is even sharper: transferring £250 via a specialist might cost just £1.35, while Santander could charge as much as £32.29 for the same transaction.

These examples highlight the importance of comparing the total cost before choosing a method. If you’re sending Euros within the Single Euro Payments Area (SEPA), it’s worth checking with your bank, as many UK banks offer free or low-cost Euro transfers. For other currencies, focus on the final amount your recipient will receive, rather than just the advertised fees. Also, funding your transfer via bank transfer (instead of a credit card, which may add 2%-3% in extra charges) and opting for standard delivery (typically 30%-50% cheaper than instant transfers) can help reduce costs.

When it comes down to it, the choice depends on your priorities. Specialist services can save you hundreds of pounds annually, especially for regular or large transfers. The question is whether the convenience of your bank is worth the extra expense, or if the transparent pricing and better rates of specialist providers are the smarter choice.

FAQs

How do hidden fees from banks affect the overall cost of sending money abroad?

When transferring money through banks, it’s common to encounter hidden fees buried within exchange rate markups or other less obvious charges. While the upfront transfer fee might appear small, these additional costs can quietly add up, making your transfer more expensive than you’d initially anticipated.

In contrast, certain services are more transparent about their fees and exchange rates, giving you a clearer picture of what you’re actually paying. To ensure you’re getting the most for your money, always take the time to review the full breakdown of charges and compare rates before making a decision.

Why are money transfer services often more affordable than traditional banks?

Money transfer services tend to be easier on the wallet, largely because they sidestep the hefty overheads that come with running traditional banks. By relying on digital platforms, they cut out the expenses tied to maintaining physical branches and large-scale infrastructure.

What’s more, these services usually charge little to no upfront fees and offer tighter exchange rate margins, ensuring you get to keep more of your money. On the other hand, banks often tack on higher hidden fees and provide less favourable exchange rates, making their options pricier in comparison.

What factors should I consider when choosing between a bank and a money transfer service for sending money abroad?

When choosing between a bank and a specialised money transfer service for sending money abroad, the overall cost is a key consideration. Banks often charge a flat fee and include a hidden markup in the exchange rate, which can make these transfers far pricier than they first appear. On the other hand, money transfer services tend to offer lower fees that are clearly displayed and use the mid-market exchange rate. This approach means you could end up with more foreign currency in your recipient’s hands.

Speed is another important factor. Bank transfers can take several business days to complete, particularly if intermediary banks are involved in the process. In contrast, many money transfer services can process payments much faster – sometimes within hours or even seconds. This is especially helpful if the funds are needed urgently.

Lastly, consider transparency and ease of use. Money transfer services usually lay out all fees upfront, allow you to lock in exchange rates, and offer a seamless online experience, complete with real-time tracking and accessible customer support. Banks, however, may have less clear fee structures and often require additional steps, such as visiting a branch or submitting extra documentation, which can make the process less convenient.