The mid-market exchange rate is the midpoint between the buy (bid) and sell (ask) prices of two currencies in the global foreign exchange market. It reflects the true value of a currency without any added fees or markups, making it a key benchmark for comparing exchange rates offered by banks and money transfer providers.

Key Points:

- Definition: The rate banks use when trading currencies with each other, sometimes through currency matching, also called the interbank or spot rate.

- Calculation: It’s calculated as (Bid Price + Ask Price) ÷ 2.

- Importance: Banks and providers often add a markup to this rate, creating hidden costs for consumers.

- Example: If the GBP/EUR bid is 1.1740 and ask is 1.1744, the mid-market rate is 1.1742.

- Impact: A £10,000 transfer at a typical bank rate of £1 = €1.10 could cost you €500 compared to using the mid-market rate. This is particularly significant for large transactions, such as when you send money from the UK to the USA.

Knowing this rate helps you identify hidden fees and make informed decisions when sending money abroad. Tools like Google Currency Converter, Xe.com, and OANDA provide real-time mid-market rates to help you compare providers and save money.

How the Mid-Market Exchange Rate is Calculated

The Calculation Formula

The mid-market rate is determined using a straightforward formula: (Bid Price + Ask Price) ÷ 2. Here’s what those terms mean: the bid price is the highest amount a buyer is prepared to pay for a currency, while the ask price is the lowest amount a seller is willing to accept.

Since the foreign exchange market operates around the clock, these rates are constantly changing. Factors like supply and demand, economic reports, and global events all contribute to these fluctuations. The formula is applied continually as market dynamics shift.

Example Using GBP to EUR

Let’s break it down with an example of converting British pounds (GBP) to euros (EUR). Imagine the GBP/EUR bid price is 1.1740, and the ask price is 1.1744.

- Add the two rates together: 1.1740 + 1.1744 = 2.3484.

- Divide the total by two: 2.3484 ÷ 2 = 1.1742.

This calculation reveals that £1.00 equals €1.1742 on the interbank market.

For major currency pairs like GBP/EUR, the difference between the bid and ask – known as the spread – is typically very small. In this case, the spread is just 0.0004, reflecting the high trading volumes and liquidity in such pairs.

sbb-itb-0f86db3

What Is The Mid-market Rate? – Learn About Economics

Mid-Market Rate vs Bank and Provider Rates

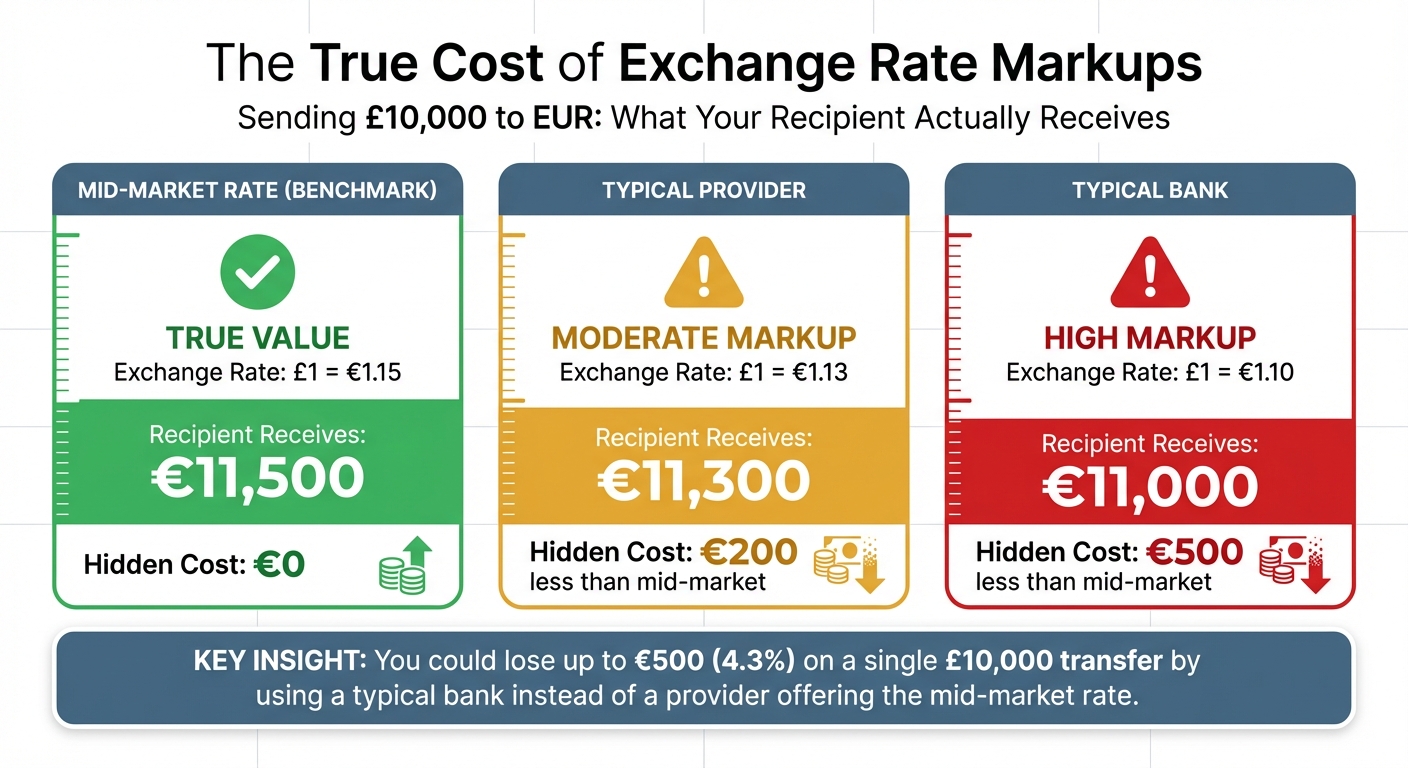

Mid-Market Rate vs Bank Exchange Rates: Cost Comparison on £10,000 Transfer

How Rate Markups Work

When you exchange money through banks or transfer providers, you’re unlikely to get the mid-market rate. Instead, they add a markup – often referred to as a ‘spread’ – to cover their expenses, manage currency fluctuations, and, of course, make a profit.

You’ve probably seen offers like "0% commission" or "no fees", but the truth is, the markup on the exchange rate creates a hidden fee. Matt Woodley, Founder of InternationalMoneyTransfer.com, puts it simply:

"The difference between the mid-market rate and the retail exchange rate represents an indirect fee for using that provider".

The size of this markup can vary widely. For instance, WorldFirst keeps its fee capped at 0.60% for direct transfers. On the other hand, PayPal not only applies higher markups but also adds extra transaction fees. Even small differences in the rate can add up. To give you an idea, a consumer lost €60 on a £1,000 transfer because they received a rate of £1 = €1.37 instead of the mid-market rate of £1 = €1.43.

Cost Comparison Example

Let’s break down how these markups can affect a real-world transfer. Imagine sending £10,000 to euros. Here’s how much the recipient would receive depending on the exchange rate used:

| Rate Type | Exchange Rate | Recipient Receives | Hidden Cost vs. Mid-Market |

|---|---|---|---|

| Mid-Market Rate | £1 = €1.15 | €11,500 | £0 |

| Typical Provider | £1 = €1.13 | €11,300 | €200 |

| Typical Bank | £1 = €1.10 | €11,000 | €500 |

As you can see, relying on a typical bank for your transfer could mean losing €500 compared to the mid-market rate on a £10,000 transaction. The "Recipient Receives" column is key – since the markup is often the biggest cost, it’s worth comparing providers carefully.

How to Find and Use the Mid-Market Exchange Rate

Where to Check the Mid-Market Rate

Finding the mid-market rate is simple, and you don’t need a bank account or any specialised knowledge to do so. Google Currency Converter is a quick and easy way to see the mid-market rate instantly. For more professional-grade data, Reuters provides real-time updates widely used in the financial world. As one source explains:

"The mid-market rate is the one that will come up if you google ‘How many pounds will I get for 1000 euro’ or ‘What’s the dollar exchange rate right now’".

For those who want more detailed insights, Xe.com is a fantastic option. It offers live rate charts covering periods from 12 hours to five years, and you can even set up mobile alerts to notify you when a rate hits your desired level. Another reliable tool is OANDA, which provides interbank rates for over 200 currencies and boasts 31 years of historical data – perfect for diving into long-term trends. Meanwhile, MyCurrencyTransfer updates rates in real-time and compares quotes from over 30 FCA-regulated providers. Even better, it doesn’t require you to sign up, making it an easy way to benchmark rates across services.

Timing also matters. The market is most active between 8am GMT and 5pm EST, when both UK and US trading desks are open. During these hours, spreads are minimal, but outside this window, lower trading volumes can lead to wider gaps between buy and sell rates. Keeping an eye on the current rates is important as they are constantly shaped by a variety of factors.

Factors That Affect Exchange Rates

The mid-market rate is highly dynamic, changing throughout the trading week due to various economic and geopolitical influences. Key drivers include economic reports, central bank decisions, and global events. For example, interest rates set by the Bank of England play a significant role. Higher interest rates often attract foreign investments, increasing demand for the pound and strengthening GBP pairs. On the other hand, inflation can have mixed effects. While moderate inflation may lead to higher interest rates and a stronger currency, prolonged high inflation can erode purchasing power and signal instability, which weakens the pound.

Geopolitical events are another major factor. Situations like elections, trade negotiations, or conflicts create uncertainty, often prompting investors to move their money into "safe-haven" currencies like the US dollar or Swiss franc. This can lead to fluctuations or a drop in GBP value. Additionally, market liquidity plays a role. During peak trading hours, rates are more stable and spreads narrower. Outside these times, lower trading activity can result in more volatile movements.

| Factor | Description | Typical Effect on GBP Pairs |

|---|---|---|

| Inflation | The rate at which prices for goods and services rise. | High inflation may lead to higher interest rates, strengthening GBP, but extreme inflation suggests instability. |

| Interest Rates | Set by the Bank of England (BoE). | Higher rates attract foreign capital, increasing demand for GBP and often strengthening its value. |

| Geopolitical Events | Elections, trade deals, or conflicts. | Uncertainty or instability often causes GBP to weaken as investors shift to safer currencies. |

| Market Liquidity | The volume of trading activity in the market. | Rates are more stable during UK/US trading hours; lower liquidity outside these times can lead to wider spreads. |

Conclusion

The mid-market rate stands as the clearest benchmark for transferring money internationally. It’s the actual exchange rate – free from hidden markups – representing the midpoint between what banks charge to buy and sell currencies to each other. As Wise aptly explains:

"The mid-market rate is considered the fairest exchange rate possible".

Understanding this rate helps you cut through claims like "zero fees" and reveals where providers are earning their profit.

Checking the mid-market rate before making a transfer is a must. Even small differences in rates can add up, as shown in the earlier cost comparison example. By comparing what your recipient is set to receive with what they would get at the mid-market rate, you can easily identify which services genuinely deliver value and which fall short. This clarity is why verifying the mid-market rate is so important.

Avoiding the hidden markups often added by banks ensures your money is exchanged at its fairest value. MyCurrencyTransfer simplifies this process by offering real-time comparisons across FCA-regulated providers, making it easier to find the best rates for your transfer.

FAQs

How can the mid-market exchange rate help me save money on international transfers?

The mid-market exchange rate, often referred to as the "real" exchange rate, is the exact middle point between the buying and selling rates in currency trading. It’s a key benchmark for anyone looking to save on international money transfers. Why? Because comparing this rate with what your provider offers can reveal hidden markups or fees.

To get the most value, opt for services that offer rates close to the mid-market rate. This way, you avoid paying inflated margins often added by banks or other providers. Tools like currency converters can help you check the current mid-market rate, giving you the information you need to make smarter decisions and keep unnecessary fees to a minimum. Picking a provider that sticks closely to this rate can make a big difference when sending money abroad.

What causes the mid-market exchange rate to change?

The mid-market exchange rate is always on the move because it reflects the midpoint between the rates at which banks buy and sell currencies. These shifts are largely influenced by supply and demand in global currency markets. For instance, if a currency is in demand, its value increases, but when demand drops, the price tends to follow suit.

Several other factors also come into play. Interest rate differences can be a major driver – higher interest rates often attract foreign investment, boosting demand for a currency. Meanwhile, political stability (or lack of it) and a country’s trade balance – whether it’s running a surplus or a deficit – can impact currency flows. On top of that, decisions by central banks, key economic reports like inflation or employment data, and geopolitical events can all cause sudden changes in the rate. Because it mirrors real-time market conditions, the mid-market rate is widely regarded as the fairest benchmark for currency exchange.

Why do banks and money transfer providers charge more than the mid-market exchange rate?

Banks and money transfer services often include a markup in the exchange rate they offer. This markup, also called a spread, is the gap between the mid-market exchange rate (the rate at which banks trade currencies among themselves) and the rate they provide to customers. Essentially, it’s how they cover their costs and secure a profit.

The challenge with this approach is that it can make the actual cost of your transaction less transparent. Knowing the mid-market rate becomes crucial – it helps you spot any added charges, so you can better understand what you’re paying and make smarter choices when exchanging money.