When sending money abroad, even small differences in exchange rates can cost you significantly. For example, in 2024, a minor shift in the GBP/EUR rate saved property buyers nearly £8,000 on a €350,000 purchase. Yet, over half of UK residents still use banks for transfers, often paying higher fees and getting worse rates. To avoid losing money, here are five practical ways to secure better exchange rates:

- Use Comparison Services: Platforms like MyCurrencyTransfer show real-time rates and fees from multiple providers, helping you find the best deal.

- Compare Rates Simultaneously: Exchange rates change quickly. Comparing providers at the same time ensures accurate comparisons.

- Time Your Transfers: Monitor market trends and transfer during favourable periods to maximise your rate.

- Avoid Banks: Banks often charge high fees and add hidden markups to exchange rates. Specialist providers are usually cheaper.

- Choose Specialist Providers: Services like Wise or Moneycorp focus on international transfers, offering better rates and lower fees.

Quick Tip: Always check the "Recipient Gets" amount, which accounts for all fees and markups, to see the true value of your transfer. By following these steps, you can save money and ensure more of your funds reach their destination.

Currency Transfer Rate: How to Get the Best Exchange Rates When You Send Money Overseas

1. Use a Free Comparison Service like MyCurrencyTransfer

A free comparison service brings together real-time data from various providers, giving you a clear picture of how much your recipient will actually receive after accounting for fees and exchange rate markups. Instead of visiting multiple websites, you can view side-by-side comparisons instantly, including exchange rates, transfer fees, and estimated delivery times. This makes it easier to identify where you can save the most.

Take MyCurrencyTransfer, for example. This platform compares over 30 FCA-regulated providers and has assisted more than 600,000 users over the past 14 years. It calculates the "Recipient Gets" amount, which reflects the actual value your recipient will receive. For instance, in January 2026, a real-time comparison of sending £1,000 to euros revealed the following: while the mid-market rate would yield €1,144.11, one provider offered €1,122.14, and another only €1,096.00 – a €48.11 difference compared to the mid-market benchmark [1].

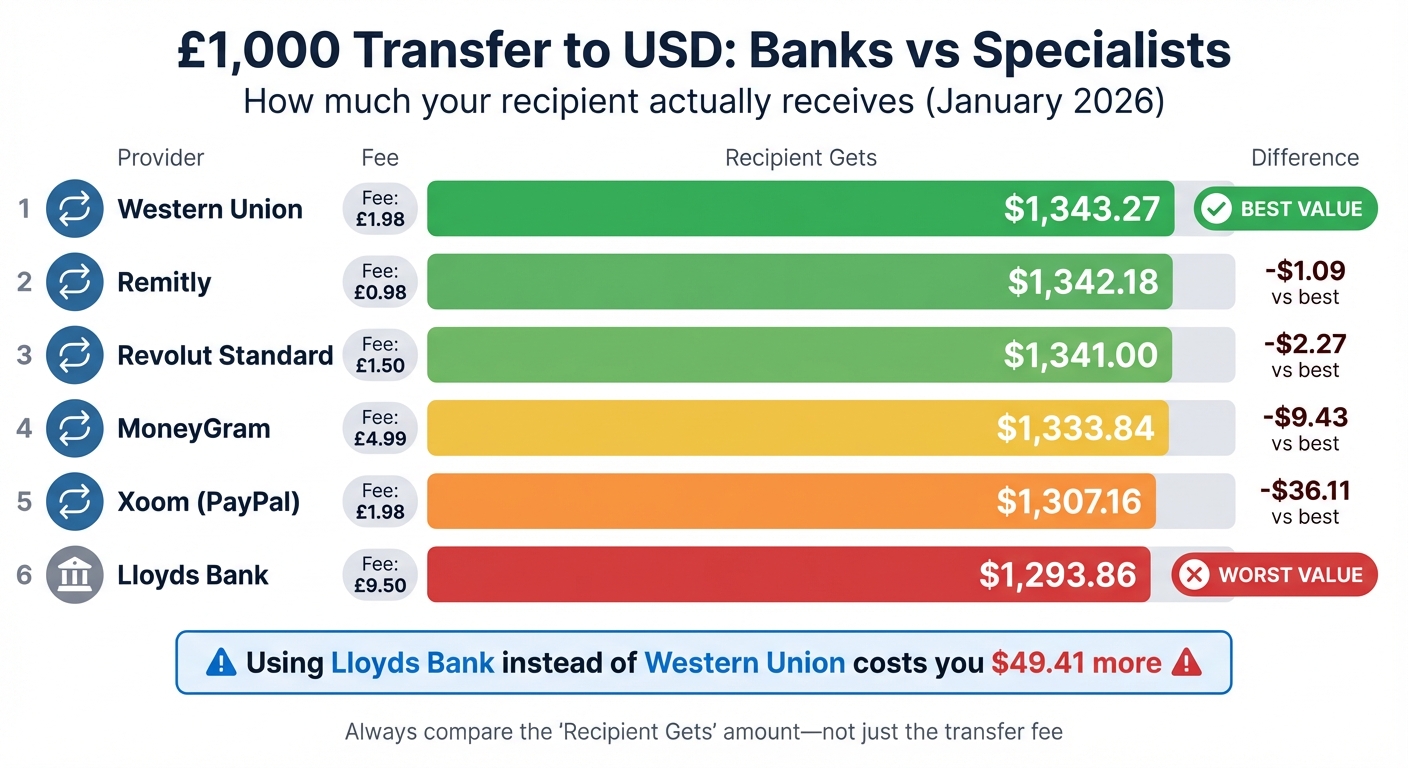

Similarly, for £1,000 sent to USD, Western Union delivered $1,343.27 (with a £1.98 fee), while Lloyds Bank provided only $1,293.86 (with a £9.50 fee). That’s a $49.41 difference in favour of Western Union [8]. These platforms update their data every 60 seconds to reflect market changes and even offer rate alerts to notify you when your preferred exchange rate is available [1][4].

"Our comparison focuses on what matters most: the amount delivered to your recipient. Rather than just showing exchange rates in isolation, we calculate the total cost including transfer fees, card fees, and exchange rate margins." – MyCurrencyTransfer

In addition to savings, MyCurrencyTransfer prioritises security and transparency. It only lists providers that are authorised by the Financial Conduct Authority (FCA), ensuring your transfers comply with UK financial regulations and your funds remain protected under UK law. On average, users report saving £247 on a £10,000 transfer compared to high street banks. Collectively, customers have saved over £50 million in fees through the platform.

2. Compare Providers at the Same Time for Real-Time Rates

When sending money internationally, timing is everything. Exchange rates are in constant motion, influenced by global financial markets, economic updates, and political developments[11]. If you check one provider at 9:00 AM and another at 11:00 AM, the rates may have shifted, making comparisons unreliable. That’s why it’s essential to compare providers at the same time using real-time data.

By comparing rates side by side, you can get a clear picture of what each provider offers. For instance, sending £1,000 to euros might yield €1,122.14 with one provider but only €1,096.00 with another – a €26.14 difference that could go unnoticed without real-time checks[1]. This approach not only highlights rate variations but also exposes hidden markups.

Some providers advertise "zero fees", but they often embed a markup in the exchange rate. Tools that calculate the final "Recipient Gets" amount can help uncover these hidden costs. As Wise explains:

"A markup added to the exchange rate is really just another fee. However, unlike upfront charges, a markup isn’t transparent, and it often means that you pay more than you need to."

The "Recipient Gets" figure – what your recipient actually receives after all fees and markups – is the most accurate way to assess the true cost of your transfer.

Speed is another factor to consider. Transfer times can vary widely between providers. For example, Revolut-to-Revolut transfers are often completed in under 20 seconds, card transfers may take anywhere from a few seconds to 30 minutes, and international bank transfers can take 3–5 business days[8]. Comparing these speeds alongside costs allows you to decide if paying more for faster delivery is worth it or if waiting a few days could save you money.

Real-time comparison platforms update their data every 60 seconds, helping you spot competitive rates quickly. By focusing on the total amount your recipient will receive and cross-checking it with the mid-market rate, you can identify which providers offer the best deals and which might be sneaking in extra charges.

3. Time Transfers Based on Market Trends

Exchange rates are constantly shifting, influenced by factors like interest rates, inflation, political events, and global economic changes [5]. While these fluctuations might seem trivial for smaller transfers, they can have a big impact on larger sums. For instance, if you’re transferring £10,000 and the rate drops from 1.20 to 1.15, your recipient could end up with around €500 less [5]. That’s a significant difference for a simple timing misstep.

Planning your transfer at the right moment can help you secure a better deal. Many international transfers happen at the end of the month or the start of a new one, driven by invoice payments and other financial obligations [12]. These periods often lead to fee spikes and processing delays. If your transfer isn’t urgent, consider scheduling it mid-month – between the 15th and 20th – when the demand is typically lower [12]. This timing strategy can add to the savings you achieve by carefully comparing providers.

The time of day also plays a role. Exchange rates are often most volatile when market sessions overlap. For example, in the UK, the London and New York markets overlap from 1:00 PM to 4:00 PM, while the Tokyo market is most active around 8:00 AM [13]. Additionally, transferring money between Tuesday and Thursday can help you avoid the delays that often occur with Monday backlogs and Friday’s end-of-week volatility [13]. These small adjustments can make a big difference when combined with other cost-saving measures.

For even more control, set up rate alerts to notify you when your target rate is reached. You can also use tools like market orders to automate transfers when rates hit your desired level or forward contracts to lock in a favourable rate for a future transfer by paying a small deposit [12].

A real-world example of timing’s importance? Back in August 2019, Brexit uncertainty caused the pound to strengthen by about 5% against the euro in a short period. Those who timed their transfers during this window managed to take advantage of a much better exchange rate [12]. Strategic timing can turn market unpredictability into an opportunity.

sbb-itb-0f86db3

4. Avoid Banks and Hidden Fees

While traditional banks might feel like a secure choice, they often come with steep costs. Many banks charge hidden markups of 2%–4% above the mid-market exchange rate [14][15]. The mid-market rate – what banks use when trading with each other – is typically the one you see online. However, UK high-street banks like Barclays, Lloyds, Nationwide, and NatWest add hefty markups on top.

The expenses don’t stop there. Banks often double-charge by combining fixed fees (sometimes as high as £30 per transaction [3]) with inflated exchange rates. For example, transferring £200,000 with a 3% markup instead of a 0.5% rate offered by a specialist provider could mean paying an extra £5,000 [14]. Even receiving money can come with a charge, usually between £2 and £7.50 [15].

Specialist providers work differently. By trading in larger volumes and partnering with multiple liquidity sources, they can offer rates much closer to the mid-market rate. Many also keep their fees low and transparent – some might even waive fees entirely for larger transfers. Instead of focusing solely on advertised fees, it’s smarter to compare the "recipient gets" amount [2][6].

Still, many people stick with banks, missing out on potential savings. To get the best value, always focus on how much your recipient will actually receive.

5. Choose Specialist Money Transfer Services

Specialist money transfer services are designed specifically for moving money across borders. Unlike high-street banks that juggle multiple services like mortgages, loans, and savings accounts, these providers focus solely on foreign exchange. This streamlined approach often translates into lower costs and better exchange rates – sometimes up to three times cheaper than traditional banks [11].

Here’s how it works: banks typically rely on the SWIFT network for international payments. Each intermediary in the network takes a fee, making the process more expensive. Specialist providers, on the other hand, avoid this by using their own network of local bank accounts, cutting out the middlemen [11][9].

To ensure safety, look for firms authorised by the FCA (Financial Conduct Authority). "Authorised" providers are required to keep customer funds separate from their own operational funds, offering an extra layer of security. You can check a provider’s status on the FCA register; for instance, Moneycorp is authorised under firm reference number 308919 [9][7].

Specialist services also offer tools that are rare with banks. These include forward contracts, which let you lock in today’s exchange rate for up to two years, and market orders, which execute transfers when your desired rate is reached. Mar Bonnin Palmer, Head of Partnerships at Moneycorp, highlights the importance of these tools:

"Large sums of currency carry more risk. At Moneycorp, we always advocate planning – that way, you can minimise your risk and take advantage of opportunities when the rates move in your favour" [7].

Beyond these features, specialist providers stand out for their speed and value. Transfers with these services often complete within 24 hours – or even instantly – compared to the 3 to 5 business days typical of banks. For amounts under £5,000, specialist FX providers are the most cost-effective choice, while currency brokers are ideal for larger transactions [9]. Wise, for example, moves over £30 billion every quarter and boasts a 4.3/5 Trustpilot rating from more than 203,000 reviews [1].

Comparison Table

Money Transfer Provider Comparison: Banks vs Specialists for £1,000 Transfer

Here’s a breakdown of how banks and specialist services compare when sending £1,000 abroad. The table below shows actual rates and fees from January 2026, highlighting how much the recipient receives in US dollars after all costs are accounted for [8].

| Provider | Type | Transfer Fee | Recipient Gets (USD) | Difference vs. Best Rate |

|---|---|---|---|---|

| Western Union | Specialist | £1.98 | $1,343.27 | – |

| Remitly | Specialist | £0.98 | $1,342.18 | -$1.09 |

| Revolut (Standard) | Specialist | £1.50 | $1,341.00 | -$2.27 |

| MoneyGram | Specialist | £4.99 | $1,333.84 | -$9.43 |

| Xoom (PayPal) | Specialist | £1.98 | $1,307.16 | -$36.11 |

| Lloyds Bank | High-Street Bank | £9.50 | $1,293.86 | -$49.41 |

This table clearly shows how fees and exchange rate markups can significantly impact the final amount received. For instance, opting for Lloyds Bank instead of Western Union results in nearly $50 less for the recipient. While Lloyds charges a £9.50 transfer fee, the larger issue lies in the exchange rate markup they apply [8].

To illustrate further, Which? reported that for a £1,000 transfer to Australian dollars, Revolut delivered $1,984, whereas Starling Bank provided $1,970 – a £14 difference [6]. These differences become even more pronounced with larger transactions. For example, comparing providers for a £200,000 transfer could mean the difference between paying a 3% fee versus a 0.5% fee, potentially saving as much as £5,000 [14].

Conclusion

To secure the best exchange rate for international transfers, focus on five straightforward strategies: use a free comparison service, monitor real-time rates, time your transfers with market trends, steer clear of banks’ hidden markups, and choose specialist providers.

Surprisingly, only 11% of people compare costs when transferring money – a small step that can significantly increase the amount your recipient receives. As Faye Lipson from Which? explains:

"Sticking with who you know doesn’t always get you a reliable service" [6].

Pay attention to the "recipient gets" figure, as it reveals the true cost after fees and markups. Hidden charges can have a big impact, particularly for larger transfers. Even minor differences in fees or exchange rates can lead to noticeable disparities in the final amount delivered.

Throughout this article, we’ve highlighted how MyCurrencyTransfer simplifies this process. By comparing over 30 FCA-regulated providers in real time, the platform ensures transparency, so you know exactly how much your recipient will receive. Trusted by more than 600,000 users over the past decade, MyCurrencyTransfer makes finding the best deal effortless – no signup required.

FAQs

How can MyCurrencyTransfer help me save money on international money transfers?

MyCurrencyTransfer helps you cut costs by letting you compare exchange rates and fees from various providers all in one place. It clearly displays the mid-market rate alongside each provider’s rate, making it simple to identify any hidden mark-ups. This level of clarity allows you to choose a service that offers the best value for your transfer.

The platform also breaks down the total costs, including any flat fees or percentage-based charges, so you can find the most economical option for your transfer amount and destination. Plus, tools like rate alerts let you track market trends and secure better rates when the time is right, ensuring your recipient gets more from the transfer.

Why should I use a specialist provider instead of my bank for international money transfers?

Using a specialist service for international money transfers can help you save both time and money. These providers often offer more competitive exchange rates compared to high-street banks, as their rates are closer to the mid-market level. Plus, their fee structures are usually more transparent, meaning more of your hard-earned pounds end up with the recipient. This can be especially important for larger transfers, where even a slight difference in rates can have a noticeable impact.

Specialist providers also excel in speed. By relying on dedicated cross-border networks, they can process transfers much quicker, bypassing the delays that traditional banking systems often encounter. Many also offer handy features like rate alerts or the ability to lock in a favourable rate ahead of time, giving you greater control over your transactions.

On top of that, their customer service is often designed with international payments in mind. They provide clear breakdowns of fees and access to expert support, making the process easier to navigate. Unlike banks, which may include hidden mark-ups or extra handling fees, these providers focus on offering a smoother and more cost-effective way to exchange currency.

How can I use market trends to get a better exchange rate when transferring money?

Timing your money transfer strategically can help you snag a better exchange rate and save some cash. Exchange rates are constantly shifting, influenced by factors like supply and demand, economic news, and geopolitical developments. By keeping an eye on these trends, you can choose to transfer when the currency you’re buying is stronger or the one you’re selling is weaker, giving you a more favourable deal.

To stay ahead, try setting up rate alerts or tracking the mid-market rate a few days before you plan to transfer. If you’re in the UK, the best times often coincide with peak market activity, such as the London-New York overlap (13:00–16:00 UK time) or the early London-Tokyo session (around 08:00 UK time). Additionally, mid-week days – Tuesday through Thursday – usually offer more stable rates compared to Mondays or Fridays, when market fluctuations are more common. These simple steps can help you stretch your money further and reduce transfer costs.