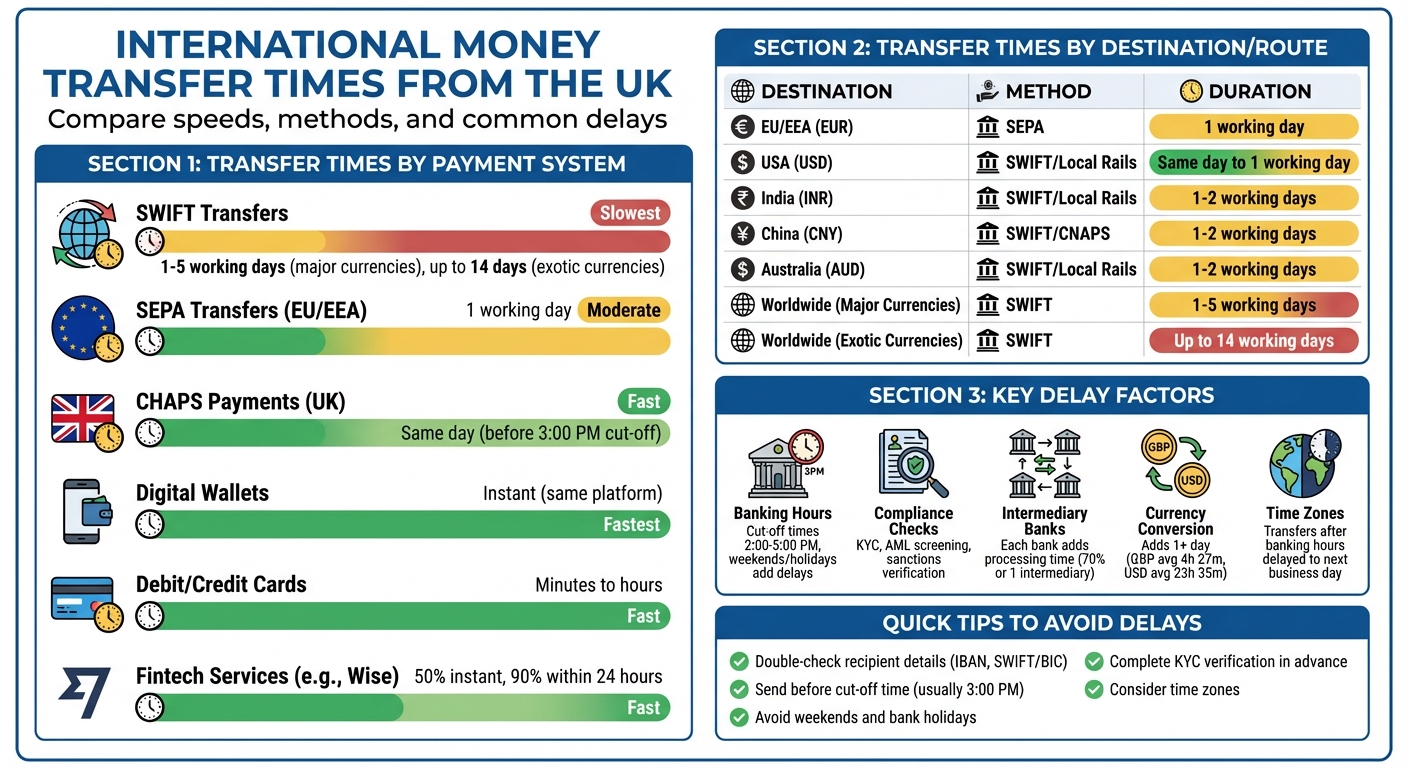

When sending money internationally, the time it takes for the transfer to complete depends on several factors, such as the payment method, destination, and currency. Here’s a quick summary:

- SWIFT Transfers: Common for global bank transfers, take 1–5 working days. Transfers involving exotic currencies or intermediary banks may take up to 14 days.

- SEPA Transfers (EU/EEA): Usually completed within 1 working day.

- Digital Wallets: Transfers can be instant if both sender and recipient use the same platform.

- Debit/Credit Card Payments: Often processed within minutes to hours.

- CHAPS Payments (UK): Same-day delivery if initiated before the 3:00 PM cut-off.

- Destination: Transfers to developed banking regions like North America or Europe are faster (1–2 days), while those to less developed areas may take longer.

Key factors influencing delays include banking hours, compliance checks, currency conversion, and intermediary banks. To avoid delays, double-check recipient details, meet cut-off times, and choose faster payment networks like fintech platforms. Tools like MyCurrencyTransfer can help you compare transfer times and fees across providers, ensuring quicker and cost-effective options.

International Money Transfer Times Comparison by Payment Method and Destination

Foreign Exchange 101: What Happens When You Send Money Abroad?

How Long Do International Transfers Take?

The time it takes for an international money transfer to go through depends on a few key factors: the payment system you choose, how you fund the transfer, and the destination. Understanding these elements can help you pick the quickest option.

Standard Transfer Times

International transfers from the UK generally follow predictable timelines. For instance, CHAPS payments sent before the 3:00 PM cut-off time can reach the recipient on the same day. SEPA transfers within the Single Euro Payments Area are usually completed within one working day. Transfers via SWIFT, which is common for major currencies, typically take anywhere from one to five working days. However, if you’re sending money to destinations with less developed banking systems or using less common currencies, the process may stretch to five working days – or even longer. In some cases, transfers involving exotic currencies can take as long as 14 days to process.

Transfer Times by Payment System

The payment network you use plays a big role in transfer speed. SWIFT, the go-to for global bank transfers, usually takes one to five working days since funds often pass through intermediary banks. SEPA payments, on the other hand, are much quicker – transfers within the EU and EEA are typically completed within one working day when requested online. For high-value or urgent payments, CHAPS offers same-day delivery, provided the transfer is initiated before the bank’s cut-off time.

Specialist fintech services, such as Wise, often offer faster alternatives by skipping SWIFT altogether and using local account networks. For example, 50% of Wise payments arrive instantly, and 90% are completed within 24 hours.

The method you use to fund the transfer also makes a difference.

Transfer Times by Payment Method

How you pay for your transfer can significantly impact how quickly it’s processed. Transfers funded by debit or credit cards are often the fastest, with delivery times ranging from a few minutes to a few hours. Faster Payments, commonly used in the UK, can take anywhere from a few seconds to two hours, while BACS transfers generally require two working days. Digital wallets also offer quick options, with transfers between users on the same platform often happening instantly.

It’s worth noting that UK banks typically have cut-off times – usually between 2:00 PM and 5:00 PM – for processing same-day payments. If you miss this window, your transfer might take an additional working day to process.

Beyond the payment network and method, the currency and destination also play a big part in determining transfer speed.

Transfer Times by Currency and Destination

The currency you’re sending and the destination country are key factors in how long a transfer takes. Major currencies like USD, EUR, GBP, AUD, and CAD are usually processed within one to two days, thanks to established banking networks. However, less commonly traded currencies can take longer to settle.

The destination’s banking infrastructure also matters. Transfers to regions like North America or Europe are often faster than those to areas with less developed systems. Time zones can further impact processing times – transfers initiated after the recipient’s banking hours will likely start processing the next business day. For example, transfers to countries like India or China usually take one to two working days.

| Destination/Route | Typical Transfer Method | Estimated Duration |

|---|---|---|

| EU/EEA (EUR) | SEPA | 1 working day |

| USA (USD) | SWIFT / Local Rails | Same day to 1 working day |

| India (INR) | SWIFT / Local Rails | 1–2 working days |

| China (CNY) | SWIFT / CNAPS | 1–2 working days |

| Australia (AUD) | SWIFT / Local Rails | 1–2 working days |

| Worldwide (Major Currencies) | SWIFT | 1–5 working days |

| Worldwide (Exotic Currencies) | SWIFT | Up to 14 working days |

Ultimately, the speed of your international transfer depends on a combination of the payment system, funding method, and destination details.

What Affects International Transfer Speed?

Even with the right payment system and method, various operational factors can still slow down international transfers. By understanding these elements, you can better anticipate potential delays and plan ahead. Let’s take a closer look at the key factors that influence transfer speed.

Banking Hours and Processing Windows

Banking cut-off times play a major role in how quickly international transfers are processed. These cut-off times, combined with network and compliance delays, often extend the transfer timeline. On top of that, differences in time zones, weekends, and public holidays – both in the UK and the destination country – can add further delays. For instance, a transfer initiated on a Friday afternoon might not even begin processing until Monday, meaning the recipient may not see the funds until Tuesday or Wednesday.

For SWIFT transfers, the situation becomes even more complex when intermediary banks are involved. Each bank in the chain operates within its own hours and observes its own holidays, which can lead to cumulative delays.

Compliance Checks and Intermediary Banks

Every international transfer undergoes rigorous security and compliance checks. Banks are required to verify the sender’s identity (KYC), screen for money laundering (AML), and ensure compliance with government sanctions lists. Transfers that are unusually large or out of the ordinary may trigger additional fraud prevention measures, which could result in funds being held for several days while the transaction is verified. While these checks are essential for security, they inevitably slow down the process.

SWIFT has highlighted how compliance checks are a significant factor in slowing cross-border payments. They’ve stated:

When it comes to preventing fraudulent transactions, or stopping funds flowing to a sanctioned individual or jurisdiction, compliance must not be sacrificed to speed.

In some cases, regulations and capital controls in the destination country can be the biggest obstacle to a quick transfer.

When the sending and receiving banks don’t have a direct relationship, intermediary (or correspondent) banks step in to facilitate the transfer. Each intermediary processes the payment, adding extra time to the transaction. That said, most cross-border payments are relatively efficient – 70% are either direct or involve just one intermediary, and 92% of SWIFT gpi payments reach the beneficiary within 24 hours.

Beyond compliance, currency conversion can also introduce delays.

Currency Conversion and Settlement

Currency conversion is another frequent cause of delays, often adding at least one extra day to the process. Banks need to perform the exchange, and for less commonly traded currencies, they may need to source them from other institutions. In February 2025, Statrys analysed 500 SWIFT payments and found noticeable differences in processing times: GBP transactions averaged 4 hours and 27 minutes, while USD transactions took 23 hours and 35 minutes. Transfers from USD to EUR were even slower, taking 1 day, 8 hours and 35 minutes, compared to EUR to GBP transfers, which averaged just 5 hours and 41 minutes.

Rather than physically moving funds, international transfers rely on crediting and debiting accounts across different jurisdictions. This requires coordination between national settlement systems, which only operate during specific hours. Differences in these operating hours can lead to delays and trapped liquidity.

If the required currency isn’t readily available, sourcing it can extend the timeline even further. However, using a multi-currency account to send and receive in the same currency can bypass the need for conversion entirely, significantly speeding up the settlement process.

sbb-itb-0f86db3

Transfer Times for Popular UK Routes

Understanding transfer timelines for common UK routes helps you plan transactions more efficiently. These estimates consider key factors influencing transfer speed, offering practical guidance for specific destinations.

GBP to EUR (SEPA Transfers)

Sending Euros within the Single Euro Payments Area (SEPA) is one of the quickest options available. Standard SEPA credit transfers usually arrive within 1 working day. Some UK banks even provide same-day SEPA payments if you initiate them before the 14:00 cut-off time.

SEPA’s streamlined system for Euro payments ensures faster processing compared to SWIFT transfers, which often involve multiple intermediary banks. However, if you set up payments through paper requests, they may take up to 2 working days, while online requests typically process within just 1 day. Although the UK is no longer part of the EU, it remains a SEPA member as a "third country", which occasionally introduces additional compliance checks.

GBP to USD (North America)

Transfers to North America generally take 1 to 3 working days, though some SWIFT network transactions can take up to 5 working days. In some cases, payments to the US may arrive the same day or the next working day, as noted by Barclays. Stripe highlights the efficiency of these routes:

Transfers between North America and Europe are typically settled quickly, because transfers between regions with direct connections are often faster.

Strong banking ties between the UK and North America contribute to quicker processing times.

GBP to Asia or Africa

Transfers to Asia and Africa typically take 1 to 5 working days. For instance, Barclays reports that payments to countries like India and China often clear within 1 to 2 working days. However, delays can occur due to fewer direct banking connections and variations in local banking systems.

When sending money to certain destinations, such as China, you’ll need to provide additional details like the CNAPS (China National Advanced Payment System) code and a clear "purpose of payment" to avoid rejections. Extra checks for anti-money laundering (AML) and know-your-customer (KYC) compliance are also common for these transfers.

Receiving Money in the UK

Once funds are received in the UK, the processing time depends on the clearing system used. Faster Payments typically clear in under 2 hours, BACS takes about 2 working days, and CHAPS can process same-day if the cut-off times are met. The timing also depends on when the sending bank releases the funds and how quickly the receiving bank processes them. Large or unusual transfers may trigger fraud prevention checks, potentially delaying clearance by several days.

Next, explore how MyCurrencyTransfer can help streamline these processes for even faster results.

How MyCurrencyTransfer Helps Speed Up Your Transfers

MyCurrencyTransfer provides a free platform that lets you compare delivery times, exchange rates, and fees from over 30 FCA-regulated providers. By doing so, it helps you sidestep traditional banks that rely on the slower SWIFT system. Instead, it highlights fintech providers that avoid intermediary banks, ensuring faster transfers. Thanks to this approach, 50% of payments are processed instantly, and 90% are completed within 24 hours. This tool complements the details outlined earlier, giving you a practical way to speed up your money transfers.

The platform also provides real-time quotes for currency pairs like GBP to Hong Kong or South Korea, so you can immediately identify which provider offers the quickest service.

Compare Transfer Times and Rates

The platform’s live marketplace breaks down transfer times, rates, and fees across different providers. Specialist providers can be up to eight times cheaper than traditional UK banks, often offering exchange rates that are 2–4% better than those at high street banks, which may include hidden markups. Additionally, you can pinpoint providers that avoid unexpected intermediary fees by using local accounts in the destination country.

Tips to Avoid Transfer Delays

- Double-check recipient details, including their full name, IBAN, and SWIFT/BIC, to prevent errors.

- Send your transfer before the cut-off time (usually around 3:00 PM) to ensure same-day processing.

- Steer clear of weekends and bank holidays in both the UK and the destination country, as banks typically process payments only on business days.

- Complete your KYC (Know Your Customer) verification in advance by uploading your ID documents early to avoid compliance-related delays.

- Be mindful of time zones, and send money when banks are open in both countries to minimise processing gaps.

Conclusion

The speed of international money transfers hinges on several factors, including the payment network, compliance checks, destination bank processes, and processing windows. For instance, SWIFT transfers typically take 1–5 working days due to intermediary steps involved, whereas SEPA transfers within the Eurozone are much quicker, often completed within a single working day.

The choice of transfer method and timing is crucial in avoiding delays. Transfers initiated before cut-off times are more likely to be processed promptly. As Xe Consumer explains:

In most cases, the receiving bank is usually to blame for the delays. Delays happen so banks can prevent fraud

This highlights the importance of providing accurate recipient details and ensuring KYC verification is completed to minimise processing issues.

Platforms like MyCurrencyTransfer make the process more straightforward by allowing users to compare delivery times, exchange rates, and fees across more than 30 FCA-regulated providers. By showcasing specialist services that bypass slower SWIFT networks and offering transparency about costs – including hidden exchange rate markups – MyCurrencyTransfer enables you to make well-informed choices that save both time and money.

For time-sensitive transactions, double-checking recipient details and adhering to cut-off times are essential steps. By mastering these aspects, you can ensure your international transfers are handled efficiently and securely.

FAQs

What are the quickest ways to transfer money internationally?

The quickest way to send money abroad usually involves using online money transfer services that accept debit or credit card payments. These transactions are often completed in just seconds or a few minutes.

Many specialised digital platforms built for international transfers also offer extremely fast processing times, especially when dealing with widely used currencies or popular destinations. However, the actual transfer time can depend on factors like the recipient’s bank processing speed or the payment method chosen.

For the fastest results, choose services that focus on speed and keep an eye out for potential delays caused by weekends, bank holidays, or time zone differences.

How do currency conversion and compliance checks affect international transfer times?

Currency conversion can sometimes add a bit of extra time to the process of completing an international transfer. Before the funds reach the recipient, the provider must convert the money into the appropriate currency for the destination. This often involves intermediary banks, which can extend the timeline. In most cases, this adds a few hours, but for less commonly used currencies or transfers requiring multiple conversions, it might take up to one business day.

Another factor that can slow things down is compliance checks. These include anti-money laundering (AML) screenings and sanctions verification. If any information provided is incomplete or flagged for further review, the transfer could be delayed while the provider verifies the details. To minimise the chances of delays, double-check that all personal details, bank account information, and the purpose of the payment are accurate and complete before starting the transfer.

How can I avoid delays when making an international money transfer?

To avoid delays with your international transfer, it’s important to double-check every detail you provide. Ensure the recipient’s name, account number, sort code or IBAN, and SWIFT/BIC code are correct. Adding a clear payment reference can also help the receiving bank process the payment more efficiently. If possible, send the funds in the destination currency and submit any required compliance documents ahead of time to minimise additional checks.

Timing matters too. Try to initiate your transfer on a working day and as early as possible to meet banking cut-off times. Steer clear of weekends and public holidays in both the sending and receiving countries, as these can add an extra 1–2 days to the process. For larger transfers, be aware that additional fraud or regulatory checks might occur. Providing all necessary information upfront can help ensure everything stays on schedule. Opting for a reliable method, like direct bank-to-bank transfers, can also help reduce delays caused by intermediaries.