When sending money internationally, fees can quickly add up, often hidden in service charges, exchange rate markups, and third-party deductions. Here’s what you need to know:

- Service Fees: Can be flat (e.g., £0–£35) or percentage-based (e.g., 0.25%–1.5%).

- Exchange Rate Markups: Typically 2%–5%, but some providers go as high as 6%.

- Third-Party Charges: SWIFT transfers often incur intermediary fees (£5–£20) and recipient bank fees (£2–£7.50).

Key Takeaway: Traditional banks are often expensive, with total costs reaching 5%–10% of the transfer amount. Specialist providers can save you up to 96% by offering better rates and transparent pricing.

To reduce costs:

- Compare providers for lower fees and better rates.

- Avoid urgent transfers unless necessary.

- Use bank transfers instead of cards to fund payments.

- Consolidate smaller transfers into larger ones when possible.

Focus on the final amount your recipient will receive, not just upfront fees, to ensure you’re getting the best deal.

International Money Transfers: Wire Transfers vs Cheaper Alternatives Explained

sbb-itb-0f86db3

How Transfer Fees Are Calculated

Getting a clear picture of how providers calculate fees can help you understand where your money is going.

Flat Fees vs Percentage Fees

Flat fees are fixed charges applied to each transaction, no matter the amount being sent. For instance, UK high-street banks charge between £0 and £35 for transfers [1]. NatWest, for example, doesn’t charge for standard online transfers but applies a £15 fee for urgent ones. Similarly, Barclays charges £0 for online transfers but £25 if you conduct the transaction in-branch [1][3][8].

On the other hand, percentage-based fees rise with the size of your transfer. For example, Co-operative Bank charges 0.25% of the total amount with a minimum fee of £8 and a maximum of £35 [1]. Deutsche Bank, however, applies a 1.5% fee with a minimum charge of €10 [3]. Some providers mix both models. Starling Bank, for instance, charges £5.50 plus 0.4% for SWIFT payments [1].

To put this into perspective: a £25 flat fee is 5% of a £500 transfer but only 0.25% of a £10,000 transfer. Similarly, a 2.5% percentage fee would add £50 to a £2,000 transfer and £250 to a £10,000 transfer [7].

Exchange Rate Markups

Exchange rate markups are often the biggest hidden cost. These are margins added on top of the mid-market exchange rate. UK banks typically add between 2% and 4% to the interbank rate [3][5], with some charging as much as 3.55% [8].

For example, a 4% markup would add £40 to a £1,000 transfer, £200 to a £5,000 transfer, and £400 to a £10,000 transfer [2]. On average, UK banks apply a 2% markup [3], but some, like Lloyds and Halifax, charge up to 3.55%, while Co-operative Bank may go as high as 4% [8].

Interestingly, providers that advertise "zero fees" often make up for it by applying exchange rate markups of 5% to 6% [4]. As Transferfees.io explains:

The advertised ‘low fee’ isn’t always the cheapest option. Services often make up for low fees with poor exchange rates that cost you 3-6% extra [4].

Intermediary and Receiving Bank Fees

When a transfer is processed through the SWIFT network, it often passes through several correspondent banks, each taking a handling fee. These fees typically range from £5 to £20 per bank [2][8], and they’re deducted from the transfer amount before it reaches the recipient. Unfortunately, these charges are rarely disclosed upfront.

Additionally, the recipient’s bank may apply a processing fee for receiving international payments. UK high-street banks, for example, charge between £2 and £7.50 per transaction [5]. If you’re sending money via SWIFT from the UK to Australia, the transfer might involve one or two intermediary banks, each taking a fee, plus a receiving bank charge. Altogether, this could reduce your transfer by £15 to £50.

Breaking down these fees helps you see how transfer costs can add up – and gives you the tools to find ways to reduce them.

What Affects International Transfer Costs

A range of factors come into play when determining the cost of international money transfers.

Transfer Amount and Destination

The size of your transfer and its destination are key elements influencing costs. For larger transfers, flat fees can be more economical. For instance, a £15 fee represents just 0.15% of a £10,000 transfer but jumps to 3% for a £500 transfer. On the other hand, percentage-based fees can add up as the transfer amount increases – a 0.4% fee means £2 on a £500 transfer but £40 on a £10,000 one.

Exchange rate markups – typically between 3% and 5% – also grow with the transfer amount. Some providers, however, offer discounts for high-value transfers, often reducing fees for amounts over £20,000 [6].

The destination of the transfer is another significant factor. Transfers to widely-used currencies like EUR or USD benefit from established banking networks and competition, keeping costs lower. For example, UK banks generally charge no fees for SEPA payments to the Eurozone, but fees for other destinations can reach up to £35 [1]. Transfers to less common currencies or remote destinations often involve higher fees and less favourable exchange rates due to limited competition and more complex processing.

Specialist providers can offer major savings compared to traditional banks. For a £2,000 transfer to USD, research shows that specialist services can be over 11 times cheaper. On average, banks charge approximately £81.84 in fees and hidden costs for a £2,000 transfer, which can climb to around £275.97 for a £10,000 transfer [7]. But there’s more to consider – transfer speed and delivery methods also affect costs.

Transfer Speed and Delivery Methods

If you need a faster transfer, expect to pay more – typically 30–50% more than standard 1–3 day services [4]. For example, UK banks like NatWest and RBS charge £15 for urgent international payments, while standard online transfers are often free of charge [1].

The way you fund your transfer also matters. Bank transfers are usually the cheapest option, while using a credit or debit card can add an extra 2–3% in processing fees [4]. While cards might provide quicker access to funds, the added cost may not always justify the convenience unless time is a critical factor.

Delivery methods further influence costs. Bank-to-bank transfers are generally the most economical. In contrast, cash pickup services, which rely on physical agent locations, tend to be pricier. Additionally, transfers using the SWIFT network may involve multiple intermediary banks, each deducting £5 to £10, which drives up the total cost [2]. The currency being transferred and the specific corridor also play a part in determining fees.

Currency Type and Corridor

The type of currency and the transfer corridor can significantly impact costs. Major currencies like GBP, EUR, and USD typically have tighter spreads and better rates due to high trading volumes. In contrast, less common currencies come with wider margins and higher fees, as providers face greater risks and liquidity challenges.

The corridor – or the specific route between two countries – also matters. Transfers between the UK and popular destinations such as the USA, Canada, or Europe (often referred to as Zone 1) generally incur lower fees. For example, Lloyds Bank charges around £12 for Zone 1 transfers, whereas Zone 2 transfers cost about £20 [2].

Globally, nearly 25% of cross-border payment corridors have total costs exceeding 3%, with the average remittance cost sitting at roughly 6–7% of the transaction amount [9][10]. Traditional banks often add exchange rate markups of 3–5% [2]. For instance, TSB charges £10 for online transfers under £5,000 to non-European destinations, increasing to £17.50 for amounts above £5,000 [1].

How to Reduce Transfer Costs

Knowing what drives transfer costs is the first step to cutting down expenses. A transfer’s total cost includes two main components: the upfront fee and the exchange rate markup. The markup is the difference between the mid-market rate and the rate offered by the provider [4]. Many services claim to offer "fee-free" transfers but often make up for it with a 3% to 6% markup on the exchange rate [2][4].

Compare Providers for Best Rates

Shopping around for the best rates is one of the easiest ways to save money. Traditional banks tend to add exchange rate markups ranging from 3% to 5%, whereas specialist services usually offer much lower overall costs [4]. Tools like MyCurrencyTransfer let you compare real-time rates, fees, and delivery times from over 30 FCA-regulated providers – all without requiring registration. This transparency makes it easier to identify hidden markups and find the cheapest option for your specific transfer. Once you spot a competitive rate, time your transfer wisely to lock in those savings.

Plan Transfers Carefully

Strategic planning can significantly reduce transfer costs. Avoid urgent or express delivery unless absolutely necessary, as instant and same-day transfers can cost 30–50% more than standard 1–3 day options [4].

It’s also better to transfer money during weekday market hours (Monday to Friday) rather than at weekends. Some digital providers increase their exchange rate markups when global financial markets are closed. For example, weekend transfers may come with higher markups.

For transfers that aren’t time-sensitive, consider using rate alerts to notify you when your target exchange rate is available. This simple feature can save you 2% to 5% on large transactions [11]. If you know you’ll need to make payments in the future – like rent or tuition fees – forward contracts can help you lock in a favourable exchange rate weeks or even months ahead [5][11]. Choosing the right transfer method can also make a big difference in cost.

Choose Low-Fee or No-Fee Options

Some transfer methods and account types can dramatically cut fees – or even eliminate them entirely. For instance, most UK banks don’t charge for Single Euro Payments Area (SEPA) transfers sent in euros to EEA countries [1][8]. Transfers made through mobile apps or online banking are often free or much cheaper than those completed in-branch or over the phone [1][2].

Using your bank account to fund transfers is typically free, while credit card payments come with an extra 2.5% to 3.5% fee. For a £1,000 transfer, a credit card could add £25 to £35 in additional costs compared to a bank transfer [11].

You can also save by consolidating transfers. Sending one large transfer each month is more cost-effective than making multiple smaller ones. For example, combining four £250 transfers into a single £1,000 transfer could reduce the effective fee rate from 1.64% to 0.41% [11]. Larger transfers, especially those over £20,000, may even qualify for automatic volume discounts from specialist providers [6].

Some services use global networks of local bank accounts to bypass intermediary and receiving bank fees entirely [2]. Additionally, accounts tailored for international use, such as the HSBC Global Money Account or Santander Edge, often come with zero transfer fees [1][2]. Transfers within the same banking group – known as intra-bank transfers – are also typically free [8].

UK Bank International Transfer Fees

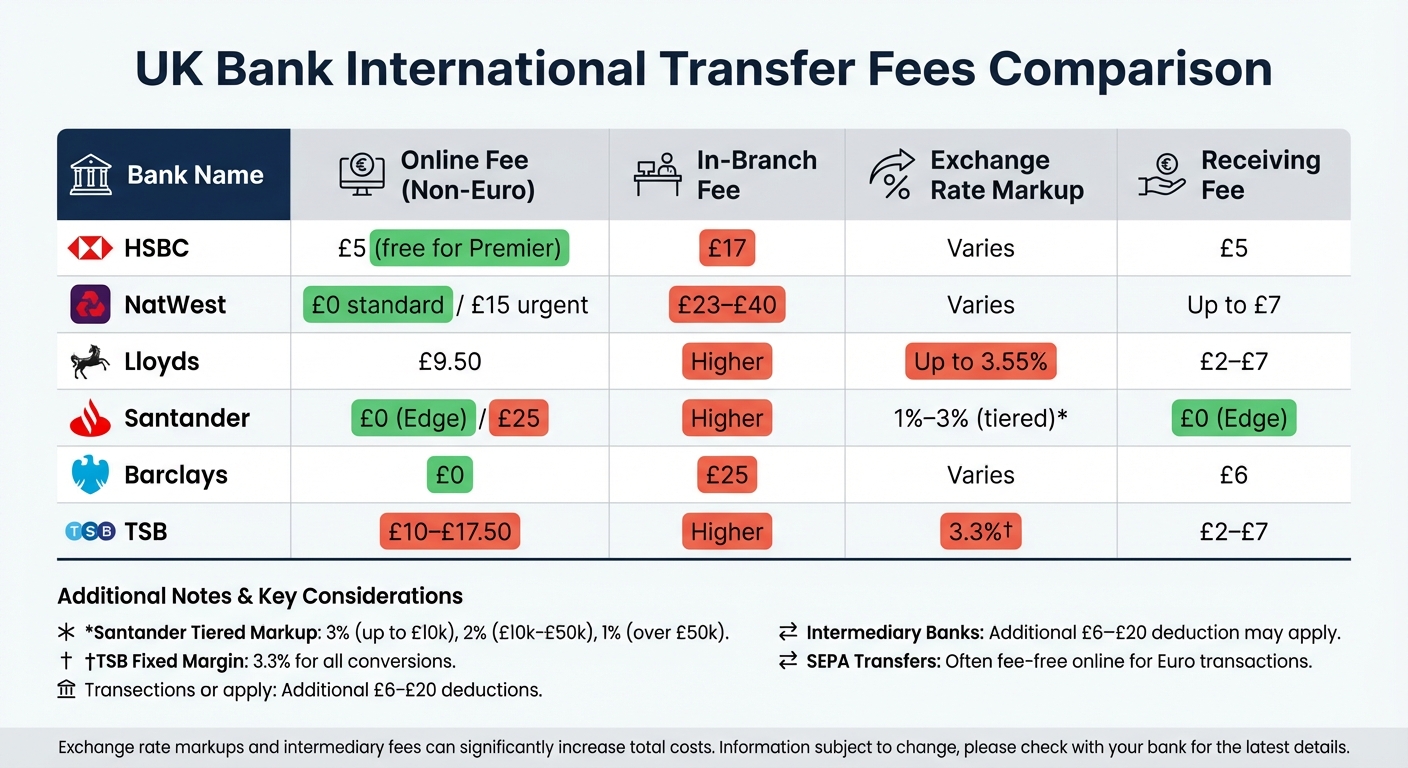

UK Bank International Transfer Fees Comparison Chart

UK banks apply a mix of upfront charges, exchange rate markups, and receiving fees for international transfers. Generally, online transfers are more economical than those made in a branch or over the phone.

Major UK Bank Fee Comparison

For non-Euro transfers, online fees range from £0 to £25, while in-branch transactions can cost as much as £40. On top of this, exchange rate markups usually fall between 3% and 5% of the transferred amount.

| Bank | Online Fee (Non-Euro) | In-Branch Fee | Exchange Rate Markup | Receiving Fee |

|---|---|---|---|---|

| HSBC | £5 (free for Premier) | £17 | Varies | £5 |

| NatWest | £0 (standard) / £15 (urgent) | £23–£40 | Varies | Up to £7 |

| Lloyds | £9.50 | Higher | Up to 3.55%[8] | £2–£7 |

| Santander | £0 (Edge) / £25 | Higher | 1%–3% (tiered)[17] | £0 (Edge) |

| Barclays | £0 | £25 | Varies | £6 |

| TSB | £10–£17.50 | Higher | 3.3%[12] | £2–£7 |

Santander applies a tiered exchange rate markup: 3% for amounts up to £10,000, 2% for £10,001–£50,000, and 1% for transfers over £50,000[17]. TSB, on the other hand, uses a fixed 3.3% margin for all currency conversions[12]. Markups from Halifax and Lloyds can go as high as 3.55%, while The Co-operative Bank’s markup can reach 4%. For those looking for lower markups, Starling Bank offers a competitive rate of just 0.4%[8].

Beyond the sender’s fees, intermediary banks in the SWIFT network can deduct an additional £6 to £20 from the transfer amount before it reaches the recipient. Receiving fees for payments over £100 typically range between £2 and £7[1][12].

When Fees Are Reduced or Waived

Euro transfers to countries within the Single Euro Payments Area (SEPA) are often fee-free when made via online or mobile banking[1][12]. Premium account holders also enjoy perks: HSBC Premier and Private Banking customers, for instance, pay no transfer fees, and the HSBC Global Money Account enables fee-free payments in over 50 currencies to more than 200 countries[13]. Similarly, Santander’s Edge Account eliminates international transfer fees altogether[17]. Barclays offers £0 fees for all online transfers, regardless of the account type, though exchange rate markups still apply[16].

Transfers within the same banking group, such as HSBC-to-HSBC, are usually free. Additionally, using digital channels can lead to significant savings. For example, Barclays charges £25 for in-branch transfers, but online transfers are free. Similarly, NatWest’s manual transfers cost between £23 and £40, while online transfers are free of charge[14][15].

It’s important to remember that even "fee-free" transfers often include exchange rate markups. Always focus on the final amount the recipient will receive rather than the absence of upfront fees. This approach ensures a clearer understanding of the total cost.

Conclusion

Understanding transfer fees is crucial when sending money internationally. The actual cost isn’t just the upfront fee – it also includes the exchange rate markup and any additional charges from intermediary or receiving banks. These extra costs can often add up to much more than the advertised fee.

The gap between the cheapest and most expensive transfer services can be significant, sometimes ranging from 5% to 10% of the total amount sent [4]. For instance, traditional banks often charge upfront fees between £0 and £35, but they also apply exchange rate markups of 3% to 6%. This makes them 70% to 90% pricier than specialist money transfer providers [4]. As Jarrad Butler, an OFX client, points out:

I think most people just assume the bank will be the best place to go to transfer money overseas, but the fees alone can really chop into that exchange rate [2].

To save money, there are practical money saving tips you can take. Always check the mid-market exchange rate and compare the actual amount your recipient will receive, rather than focusing solely on the advertised fees. Additionally, funding your transfer via a bank account instead of a credit card can help you avoid extra processing fees of 2% to 3% [4].

FAQs

How can I reduce exchange rate markups when sending money overseas?

When transferring money internationally, steer clear of high exchange rate markups by choosing providers that offer the mid-market exchange rate and keep their fees low and transparent. It’s always a smart move to compare rates across different services to make sure you’re getting the most favourable deal. Another tip? Stick to bank-to-bank transfers instead of using credit cards, as the latter often comes with additional fees or higher markups. Paying attention to these details can help you cut down on unnecessary costs when sending money abroad.

Why should I use a specialist provider instead of a bank for international money transfers?

Specialist providers often deliver lower fees and better exchange rates compared to high-street banks. Banks tend to charge higher margins and flat fees, sometimes exceeding £25 per transfer. In contrast, specialist providers aim to offer rates closer to the mid-market rate, meaning more of your money reaches its destination.

Beyond saving money, these services are usually quicker and easier to use. While bank transfers can take several days, specialist providers often complete transactions the same day or even within hours. Their platforms are designed with simplicity in mind, featuring tools like live rate trackers to help you secure the best deal. Many also offer personalised support, making the entire process more convenient and tailored to your needs.

If you’re looking to save on costs, speed up transfers, and simplify the process, specialist providers are a great alternative to traditional banks for international money transfers.

What are intermediary and receiving bank fees, and how do they affect the cost of an international money transfer?

Intermediary banks, also known as correspondent banks, serve as the go-between for the sender’s and recipient’s banks during a transfer. These banks often charge a fee for their role in processing the transaction. This fee can either be a fixed amount (for example, £4–£12) or a small percentage of the total transfer. The catch? These charges are often not disclosed upfront, which means they can unexpectedly drive up the overall cost of your transfer.

On top of that, the recipient’s bank may impose its own fee for handling the incoming funds. This fee depends on the bank’s policies and the currency being transferred. The amount is deducted from the transfer before it reaches the recipient, reducing the final sum they receive. When combined, these hidden fees can take a significant bite out of your transferred amount.

To avoid unpleasant surprises, it’s essential to recognise that the total cost of an international transfer includes the sender’s fee, intermediary bank fees, and the recipient bank’s fee. Opting for a provider that transparently reveals or covers these charges can help you cut costs and ensure more of your money reaches its intended destination.