When sending money internationally, the exchange rate and fees can significantly affect the amount your recipient receives. Wise and Revolut are two of the most popular platforms for currency transfers, but they handle exchange rates and fees differently:

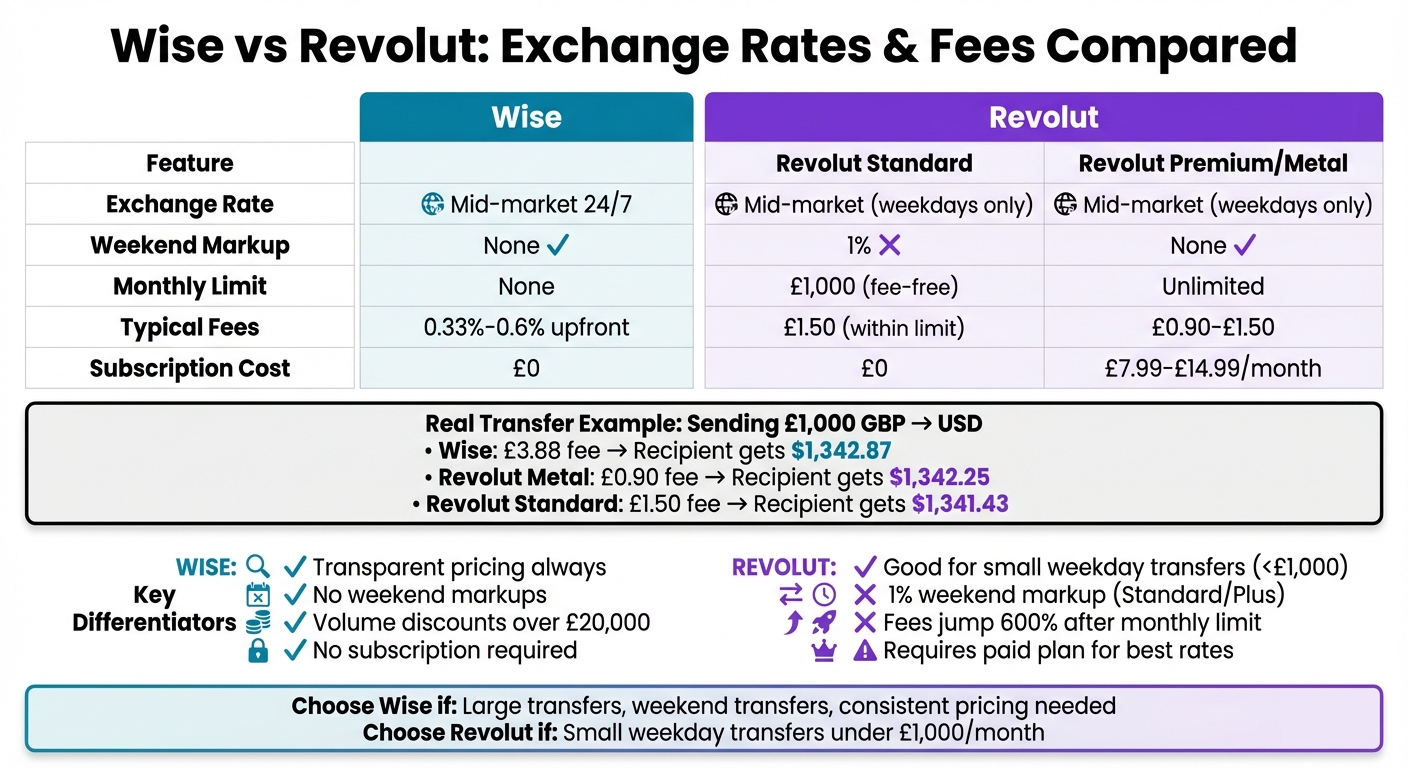

- Wise offers the mid-market rate 24/7 with no markups, charging a clear, upfront fee (typically 0.33%–0.6% of the amount transferred). No subscription is required, and fees remain consistent, even on weekends.

- Revolut provides the mid-market rate on weekdays but adds a 1% markup from Friday evening to Sunday evening. Free exchanges are capped at £1,000 per month for Standard users, with higher limits or unlimited exchanges available on paid plans.

Key takeaway: Wise is predictable and transparent, making it ideal for large or frequent transfers. Revolut can be cost-effective for small weekday transfers under £1,000, especially for those on higher-tier plans.

Quick Comparison

| Feature | Wise | Revolut Standard | Revolut Premium/Metal |

|---|---|---|---|

| Exchange Rate | Mid-market 24/7 | Mid-market (weekdays) | Mid-market (weekdays) |

| Weekend Markup | None | 1% | None |

| Monthly Limit | None | £1,000 (fee-free) | Unlimited |

| Fees | 0.33%–0.6% upfront | £1.50 (under limit) | £0.90–£1.50 |

| Subscription Cost | None | £0 | £7.99–£14.99 |

Choose Wise for consistent, transparent fees and rates. Opt for Revolut if you prefer a subscription model with added perks and lower costs for small transfers.

Wise vs Revolut Exchange Rates and Fees Comparison

Wise Exchange Rates and Fees

How Wise Exchange Rates Work

Wise uses the mid-market rate around the clock – the same rate you’d find on Google or Reuters – without any hidden markups[4]. This rate remains steady throughout the week, even on weekends. Unlike other providers that adjust their spreads or tack on extra fees when markets close, Wise sticks to its straightforward pricing model[2].

Wise Fee Structure

Wise keeps things simple with a single upfront fee, typically ranging from 0.33% to 0.6% of the transfer amount. This fee is displayed clearly before you finalise your transaction[4].

For instance, if you’re sending £1,000 from the UK:

- GBP to EUR or GBP to AUD transfers cost £3.88

- GBP to USD transfers cost £4.67

- GBP to INR transfers cost £5.68[5]

If you’re transferring more than £20,000 in a month, you can benefit from volume discounts, which lower the percentage fee as the transfer amount increases[4]. Additionally, using a bank transfer to fund your transaction keeps processing costs lower compared to paying with a debit or credit card[5].

This transparent fee structure highlights Wise’s dedication to clarity, making it a standout choice when comparing exchange platforms. Combined with competitive fees, Wise also offers flexible transfer limits to suit both small and large transactions.

Transfer Limits on Wise

Wise operates on a pay-as-you-go basis, with no subscription plans or tiers. Card spending is capped at €30,000 per month[3], but bank transfers allow for much higher limits.

There are no restrictive caps requiring you to upgrade to premium plans for better rates or higher limits. Whether you’re transferring £100 or £100,000, you’ll always benefit from the mid-market rate and upfront fees. For users in the US, even higher limits are available for ACH and SWIFT transfers[1].

sbb-itb-0f86db3

Revolut Exchange Rates and Fees

Revolut Exchange Rates by Subscription Tier

Revolut provides the mid-market exchange rate on weekdays – the real-time rate sourced from independent data providers [6]. However, the availability of this rate depends on your subscription tier and how much you’ve exchanged that month.

For Standard users, fee-free exchanges are capped at £1,000 per month. Plus subscribers get a higher monthly allowance of up to £3,000. Meanwhile, Premium, Metal, and Ultra members enjoy unlimited exchanges without any monthly limits.

If you exceed these thresholds, additional charges apply. This tiered structure means your exchange costs can vary widely depending on your subscription plan and the timing of your transactions. Let’s take a closer look at the extra fees and markups that may affect your costs.

Revolut’s Extra Charges and Markups

Revolut applies two main types of additional fees that can increase your exchange costs: weekend markups and fair usage fees.

The weekend markup applies from Friday 17:00 Eastern Time to Sunday 18:00 ET, when currency markets are closed. During this time:

- Standard users face a 1% weekend markup and an additional 1% fair usage fee once they exceed their £1,000 monthly limit.

- Plus users are charged 0.5% for both the weekend markup and fair usage fee.

- Premium, Metal, and Ultra users are exempt from these fees entirely.

"You may also pay an additional currency exchange fee, depending on your plan, the amount you’re sending, and the time of your transfer." – Revolut [6]

Fair usage fees kick in once you exceed your monthly allowance. For example, in May 2025, a Standard user who exchanged £1,000 after surpassing their limit would see their fees jump from around £1.50 to £11.50 – an increase of 600% [2].

Monthly Limits by Plan

| Plan | Monthly Cost | Exchange Limit | Fair Usage Fee | Weekend Markup |

|---|---|---|---|---|

| Standard | £0 | £1,000 | 1% | 1% |

| Plus | £3.99 | £3,000 | 0.5% | 0.5% |

| Premium | £7.99 | Unlimited | 0% | 0% |

| Metal | £14.99 | Unlimited | 0% | 0% |

| Ultra | £55 | Unlimited | 0% | 0% |

If you often exchange more than £1,000 per month or make transfers on weekends, upgrading to a paid plan could save you money. Higher-tier subscribers – Premium, Metal, and Ultra – also enjoy discounts on international transfer fees: 20% off for Premium, 40% off for Metal, and completely free transfers for Ultra members. This tiered pricing structure can significantly influence the overall value when comparing exchange options across platforms.

Exchange Rate Comparison: Wise vs Revolut

Rate and Fee Comparison Table

To see which platform offers better value, let’s look at a real-world example of sending £1,000 GBP to USD. The data, based on January 2026 rates, is summarised below:

| Provider | Service Fee | Exchange Rate | Recipient Gets |

|---|---|---|---|

| Wise | £3.88 | 1.34345 (Mid-market) | $1,342.87 |

| Revolut Metal | £0.90 | 1.34345 (Mid-market) | $1,342.25 |

| Revolut Standard | £1.50 | 1.34345 (Mid-market) | $1,341.43 |

This table lays out the costs clearly, showing how fees and exchange rates affect the final amount received. But the story doesn’t end here – real-life scenarios reveal more about how these differences play out.

Practical Transfer Examples

Let’s dive into a few scenarios to understand the impact of these fees and rates on actual transfers.

For instance, data from November 2024 showed that Revolut Standard users faced a sharp increase in fees after exceeding their monthly limit. While the first three £1,000 transfers cost £1.50 each, the fee jumped to £11.50 for subsequent transfers. This makes budgeting tricky for frequent users. For more money saving tips and currency news, check out our latest guides.

Timing also plays a role. Weekend transfers with Revolut Standard come with an extra 1% markup, adding to the overall cost. In contrast, Wise keeps its fees consistent and transparent, no matter when you transfer.

When it comes to larger sums, Wise often comes out ahead. For a £10,000 transfer, Revolut Standard users would face an additional 1% fee on £9,000 of the transfer (around £90 extra) after the initial £1,000 is covered. Wise avoids these restrictions and even offers discounted rates for transfers exceeding £20,000.

"There’s no such thing as a free transfer. Unexpected costs hide in an unfair exchange rate." – Wise

The key takeaway? Always compare exchange rates to see both the upfront fee and the actual amount your recipient will receive. A low or zero fee might sound appealing, but hidden costs in unfavourable exchange rates or extra charges can make a big difference.

Which Platform Has Better Exchange Rates?

Main Findings

Wise stands out for its transparency and consistency. It always uses the mid-market rate, paired with a fixed fee starting at 0.41%. For transfers over £20,000, Wise offers an automatic discount, making it a cost-effective option for large transactions.

Revolut’s fees depend on usage and subscription level. The Standard plan is suited for smaller weekday transfers under £1,000 per month. However, exceeding this limit causes fees to rise significantly – from £1.50 to £11.50 per transfer. Additionally, weekend conversions come with a 1% markup, a charge that Wise avoids. Revolut’s Premium (£9.99/month) and Metal (£14.99/month) plans eliminate these restrictions but require a monthly subscription.

The key difference comes down to predictability versus flexibility. Wise offers consistent pricing across all scenarios, while Revolut’s costs vary depending on timing, volume, and subscription. These variables can add up quickly for users who send money frequently or make transfers on weekends.

These factors highlight clear choices depending on your transfer needs.

Choosing the Right Platform for Your Needs

Choose Wise if you value transparent fees, consistent rates, and no subscription commitments. It’s ideal for those transferring large sums, sending money on weekends, or managing ongoing international payments – like expatriates or small business owners dealing with suppliers. The automatic discount for transfers over £20,000 makes it particularly appealing for high-value transactions.

Choose Revolut if your monthly transfers stay under £1,000 and you can plan them for weekdays. It’s a good fit for occasional travellers or users who want an all-in-one app with added perks. If you’re already considering Revolut’s Premium or Metal plans for benefits like travel insurance or airport lounge access, the unlimited exchange allowance becomes a nice bonus.

Wise vs Revolut – 2025 | Which is Really Better? – Detailed Comparison

FAQs

What are the key differences in fees between Wise and Revolut?

Wise keeps things simple with its fees. It charges a low percentage fee, typically ranging from 0.4% to 0.6%, along with a small fixed amount for each transfer. There are no subscription fees, meaning you only pay when you use the service.

Revolut, in contrast, provides a free Standard plan but caps fee-free transfers at £1,000 per month. If you exceed this limit, a 0.5% fee kicks in, and weekend transfers come with an extra 1% charge. For those who want unlimited transfers, Revolut offers paid plans, which can go up to £55 per month.

What makes Wise a good choice for transferring large amounts of money?

Wise stands out as a great choice for transferring large sums of money, thanks to its use of the real mid-market exchange rate. This means you avoid the hidden mark-ups that banks and other providers often tack on. Their fees are transparent and charged as a small percentage of the transfer amount, typically ranging between 0.4% and 0.6%. Even better, these fees remain consistent regardless of the transfer size. For those sending over £20,000 per month regularly, Wise offers discounted rates, making it a more economical option for high-value transactions.

What’s more, Wise keeps things simple with consistent pricing – there’s no need for monthly subscriptions. You’ll always know exactly what you’re paying, which makes it perfect for big-ticket payments like buying property, paying tuition fees, or covering business costs. The platform is also built to handle large transfers with ease, offering high limits, secure processing, and fast delivery to ensure your money gets where it needs to go without delay.

How does Revolut’s subscription plan impact exchange rates?

Revolut’s subscription plans influence the exchange rates you get. If you’re on the Standard plan, you can convert up to £1,000 per month at the mid-market rate without any fees. However, once you go over this limit, a 0.5% fee kicks in. On top of that, a 1% surcharge applies to conversions made over the weekend.

For those on paid plans, there’s no limit on monthly currency conversions, but you’ll pay a fixed subscription fee instead. These plans can help you avoid the fair-usage fee, but whether they’re cost-effective depends on how frequently you make transfers and the amounts involved. Picking the right plan comes down to understanding your transfer needs and habits.